States hit ‘Delete’ on some sales tax measures | TaxConnex

TaxConnex

AUGUST 1, 2024

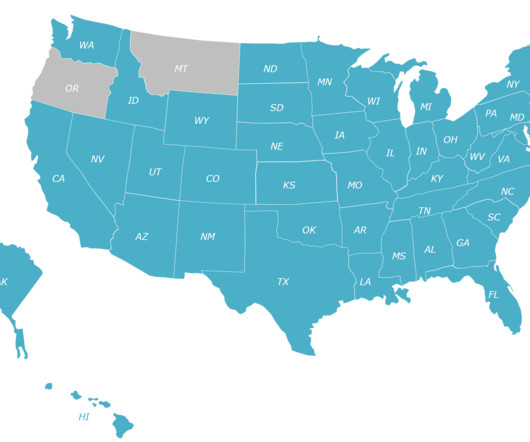

If it seems like jurisdictions just ceaselessly add additional sales tax laws, statutes and restrictions, recent news out of three states should be refreshing. The state’s economic nexus threshold is now just $100,000 in sales into the state annually. The repeal kicks in after 2024. 1, 2024, and before July 1, 2025.

Let's personalize your content