Infrastructure Law Sunsets Employee Retention Tax Credit Early

RogerRossmeisl

NOVEMBER 29, 2021

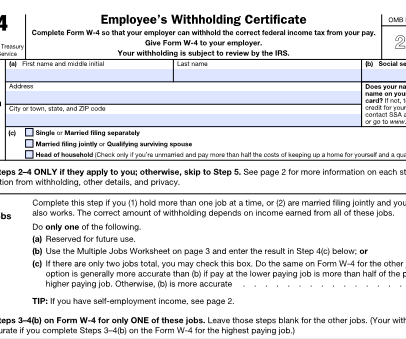

The Employee Retention Tax Credit (ERTC) was a valuable tax credit that helped employers survive the COVID-19 pandemic. It now only applies through September 30, 2021 (rather than through December 31, 2021) — unless the employer is a “recovery startup business.” The American Institute of Certified.

Let's personalize your content