Brainard vows corporate tax hike with Trump cuts set to expire

Accounting Today

MAY 10, 2024

President Biden's top economic advisor pledged Democrats would push to reverse Donald Trump's corporate tax cuts next year.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Accounting Today

MAY 10, 2024

President Biden's top economic advisor pledged Democrats would push to reverse Donald Trump's corporate tax cuts next year.

CPA Practice

MAY 7, 2024

taxes are likely to rise as lawmakers look to narrow the federal deficit, Warren Buffett said, as Washington prepares for major tax negotiations next year. Higher taxes are quite likely, and if the government wants to take a greater share of your income or mine or Berkshire’s, they can do it. ©2024 Bloomberg L.P.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ThomsonReuters

FEBRUARY 22, 2024

It is inevitable that in the next few years, it will impact – and even transform – how corporate tax professionals go about their work. So, what are the key aspects of AI that are likely to affect the world of corporate tax? Here are the top five AI terms corporate tax professionals need to know: 1.

Accounting Today

JANUARY 3, 2024

Fifteen states are reducing either individual or corporate income taxes this year, with some states trimming both individual and corporate taxes, among 34 states starting the year with significant tax changes.

CPA Practice

MARCH 7, 2024

On Thursday night, President Joe Biden gave his 2024 State of the Union Address to a joint session of Congress. The President set out his plan to reduce the deficit by $3 trillion over 10 years by increasing taxes for the wealthiest individuals and corporations. Mark Friedlich , ESQ., Mark Friedlich , ESQ.,

ThomsonReuters

FEBRUARY 9, 2024

As we step into a new year, the taxation realm is abuzz with discussions surrounding the Tax Relief for American Families and Workers Act of 2024. However, amidst this spotlight, there are other tax proposals quietly gaining momentum. Firms must prepare for potential shifts in tax liabilities and advise clients accordingly.

CPA Practice

MAY 23, 2024

By Rocio Fabbro, Quartz (TNS) World leaders are floating the idea of levying a global tax on the world’s richest people—and America wants no part of it. will not support discussions about a global wealth tax ahead of a meeting with leaders from the Group of 7 countries, The Wall Street Journal reported Monday. “But

CPA Practice

MAY 24, 2024

The American Institute of CPAs (AICPA) submitted comments to the Internal Revenue Service (IRS) containing 189 recommendations regarding the 2024-2025 Guidance Priority Plan.

ThomsonReuters

MARCH 1, 2024

Jump to: How are S corporations taxed? How can S corporations reduce their taxes? You may wonder how the S corporation taxation generally works. Are you really doing everything you can to reduce your tax burden? How are S corporations taxed? When are S corps taxes due?

CPA Practice

MARCH 9, 2023

Taylor, Kiplinger Consumer News Service (TNS) President Biden’s FY 2024 budget—released today—proposes several tax changes aimed at wealthier taxpayers. Among the tax proposals, which will likely stall in a divided Congress, are notable tax rate increases for Medicare and capital gains.

CPA Practice

MARCH 15, 2023

Taylor, Kiplinger Consumer News Service (TNS) President Biden’s FY 2024 budget—released today—proposes several tax changes aimed at wealthier taxpayers. Among the tax proposals, which will likely stall in a divided Congress, are notable tax rate increases for Medicare and capital gains.

KROST

FEBRUARY 2, 2024

Every year, taxpayers are required to file, report, and pay any taxes owed from the previous year. As the tax season begins, it is crucial to gather all forms of tax documentation in preparation for the filing process. The post Important 2024 Tax Deadlines You Don’t Want to Miss appeared first on KROST.

Menzies

DECEMBER 1, 2022

From 1 April 2023, the corporation tax rate will be increasing from 19% to 25% for companies with taxable profits over £250,000. Companies with taxable profits of less than £50,000 will continue to pay tax at 19%. However, if the company changed its year end to 31 March 2023 it would pay tax at 19%.

CPA Practice

MAY 9, 2024

More than three-fourths (77%) of tax professionals believe AI technology can be applied to their work, and more than half (56%) of in-house corporate tax teams think their external tax advisers’ firms should be using AI, shows a new report by Thomson Reuters.

ThomsonReuters

MARCH 6, 2024

In the corporate tax space, just as the regulatory compliance landscape becomes more challenging and reporting requirements become more demanding, technology is advancing rapidly to crunch vast amounts of data in no time and streamline labor-intensive processes. AI is adept at supporting both.

ThomsonReuters

APRIL 17, 2024

The emergence of g enerative artificial intelligence ( GenAI ) has sparked both excitement and apprehension in the tax industry, with professionals divided on its potential impact. Access full report The new report The Thomson Reuters Institute has released its latest report on GenAI, titled 2024 GenAI in Professional Services.

CPA Practice

MAY 9, 2024

Erik Wasson Bloomberg News (TNS) The cost of extending the 2017 tax cuts for households, small businesses and the estates of wealthy individuals enacted under President Donald Trump has expanded to $4.6 Extending the personal income tax cuts will cost $3.8 Extending the personal income tax cuts will cost $3.8 trillion alone.

Xero

MARCH 13, 2024

These include changes to National Insurance (NI) contributions effective from 6 January (followed by a second change effective 6 April), a new Scottish tax band and holiday pay reform. Investment Zone NI categories From 6 April 2024, HMRC are introducing new NI categories for employees that work in the specified Investment Zones.

CPA Practice

MARCH 4, 2024

By Justin Sink, Bloomberg News (TNS) President Joe Biden will advocate plans to increase taxes on the wealthy and corporations as well as to lower prescription drug prices in his State of the Union address this week, in what aides describe as an effort to lay out second term proposals for protecting and implementing his economic agenda.

CPA Practice

MARCH 15, 2024

He said the moves would reverse many large tax breaks enacted by the Trump administration. The president said he would like to see the corporate tax rate rise to 28%, and what’s known as the corporate minimum tax rate increased to 21%. Q: Is President Biden on the right track with his tax increase proposals?

TaxConnex

AUGUST 15, 2023

There’s always something changing in the world of tax, especially sales tax. Midyear sales tax. The Tax Foundation released its “State and Local Sales Tax Rates, Midyear 2023” report of the 45 states (and the District of Columbia) that collect statewide sales taxes and the 38 states where local sales taxes are collected.

CPA Practice

APRIL 5, 2024

TNS) A Kennewick tax preparer cost the United States $42 million in lost tax revenue between 2017 and 2020 after filing tax returns that were riddled with errors, fabrications and fraudulent entries, alleges the Department of Justice. By Annette Cary, Tri-City Herald, Kennewick, Wash. The complaint also asks that U.S.

CPA Practice

OCTOBER 2, 2023

By Katelyn Washington, Kiplinter Consumer News Service (TNS) The IRS has granted Louisiana tax relief to areas of the state impacted by seawater intrusion. Affected taxpayers now have extended tax deadlines of Feb. 15, 2024, to file certain tax returns and make tax payments. 16, 2024, are now due Feb.

Menzies

JANUARY 29, 2024

Research and Development (R&D) tax relief is a highly valuable relief to promote and reward attempts by companies to achieve advances in scientific or technological fields or appreciable improvements in associated processes. Tax saving increases by up to £2.80 Tax saving increases by up to £2.80 of enhanced amount = £33.35

ThomsonReuters

MAY 22, 2024

They are also opportunities to hear experts at the forefront of tax technology discuss the trends and challenges that tax professionals can expect to encounter very shortly. For example, Chris Reich kicked off the session by asking: “What are the forces shaping indirect tax?” It’s coming.

CPA Practice

JANUARY 8, 2024

By Stephanie Lai and Jennifer Jacobs, Bloomberg News (TNS) Donald Trump plans to make permanent the 2017 individual tax cuts that he enacted as president while keeping corporate tax levels unchanged in an appeal to working- and middle-class voters should he retake the White House, according to people familiar with the matter.

Dent Moses

MAY 8, 2024

This outlines how the administration would implement the President’s tax policy, indicating a gross tax hike of approximately $5.3 trillion from 2024 to 2034. Notable Provisions: Increased Taxes on High Earners: Increase income taxes for individuals earning more than $400,000 per year.

CPA Practice

JUNE 1, 2023

Before early 2024, tax teams must learn how to balance the additional requirements of the Base Erosion and Profit Shifting (BEPS) 2.0 Pillar Two will impose new data reporting requirements and additional global tax compliance challenges for multinational business with turnover greater than 750M EUR. By David Woodworth.

CPA Practice

MARCH 26, 2024

By Laura Davison, Bloomberg News (TNS) The progressive rallying cry of “tax the rich” has morphed into a popular policy stance with voters in the key states that will decide the 2024 election, enjoying support even among those who prefer billionaire Donald Trump, according to the latest Bloomberg News/Morning Consult poll.

ThomsonReuters

APRIL 21, 2024

For corporate tax professionals, navigating the ever-evolving landscape of tax codes and regulations is often a daunting task. This straightforward task becomes a monumental challenge when dealing with complex tax codes, global operations, and time constraints. To illustrate the scale of the challenge, in the U.S.

Accounting Insight

MAY 9, 2024

Elements automates workflows and utilises a single client record, enabling firms to onboard clients, produce and file accounts, conduct tax calculations, submit returns to HMRC and conduct practice-wide anti-money laundering compliance on a single cloud platform. You can register for a free ticket here.

Going Concern

JANUARY 25, 2024

An incredible phenomenon is underway, one that many tax pros have been begging their compadres to get on board with for years: CPAs are increasing their fees. Client graduated # 1 in accounting and so doesn’t need us to do his simple tax returns anymore. My tax preparer told me her price is increasing to [whatever dollar amount].

ThomsonReuters

DECEMBER 22, 2023

As emerging technologies continue to reshape industries, tax departments are not exempt from the transformative power of innovation. In this era of rapid change, corporate tax professionals must stay ahead of the curve and leverage the latest tools and strategies to navigate the complex landscape of tax compliance.

Dent Moses

MAY 1, 2024

This outlines how the administration would implement the President’s tax policy, indicating a gross tax hike of approximately $5.3 trillion from 2024 to 2034. Notable Provisions: Increased Taxes on High Earners: Increase income taxes for individuals earning more than $400,000 per year.

CPA Practice

MAY 22, 2023

The American Institute of CPAs (AICPA) submitted a letter to the Internal Revenue Service (IRS) containing 182 suggestions regarding the 2023-2024 Guidance Priority List.

ThomsonReuters

AUGUST 2, 2023

As the Organization for Economic Co-Operation and Development’s (OECD) ground-breaking Base Erosion Profit Shifting (BEPS) framework for taxing the digital economy is being implemented, countries around the globe are beginning to roll out the second of the OECD’s two BEPS pillars—Pillar 2.0.

CPA Practice

APRIL 11, 2024

Smith, Bloomberg Opinion (TNS) Back in 2017, the debate around President Donald Trump’s tax cuts was a case study in how quickly a discussion around legitimate policy can descend into partisan nonsense. On one side, Republicans spouted unfounded claims that the tax cuts would pay for themselves. In 2022, federal revenue came in at $4.9

CPA Practice

MARCH 12, 2024

By Laura Davison, Lauren Vella and Erin Schilling, Bloomberg News (TNS) President Joe Biden’s budget proposal—which calls for sweeping tax increases on corporations and the wealthy—is the opening round of a looming tax fight set to consume Washington next year. rate in Trump’s tax law.

Wellers Accounting

JANUARY 22, 2024

Tom Biggs ACA CTA, provides a comprehensive list of the tax and financial dates you need marked up in your calendar.

Ronika Khanna CPA,CA

APRIL 19, 2024

Residents of Canada are required to reflect all sources of worldwide income on their personal tax returns. not TFSA, RRSPs or FHSAs), to ensure that you have received all tax documents and report them. If you do make a withdrawal during the year, you will receive a T4RSP slip which is to be reported on your tax return.

Withum

APRIL 28, 2022

For the latest news and updates on Nebraska state and local tax. Nebraska Implements Corporate Income Tax Rate Reductions. 873 which reduces Nebraska’s corporate income tax rate over the next five years. However, the extension does not apply to estimated tax payments. Tax Filing and Deadline Extended.

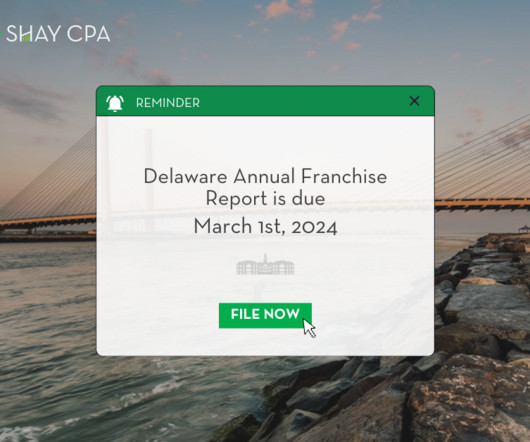

Shay CPA

FEBRUARY 8, 2024

Every corporation incorporated in the State of Delaware is required to file an Annual Franchise Tax Report and pay the associated franchise taxes. The purpose of this tax is to maintain the corporation’s good standing status within the state.

Going Concern

APRIL 12, 2024

ICYMI: These are the most-read articles on Going Concern this week: Tax Preparer Finds Out in the Worst Way Possible That ERC Wasn’t a Free Money Glitch Survey Says: Which Group of Auditors Are Most Satisfied With Their Salaries? With less than a week left before the federal tax filing deadline, Doug Blattman is in panic mode.

ThomsonReuters

MARCH 4, 2024

Preparers have the following perfection periods to correct and retransmit tax returns or extensions that were filed on time but were rejected by the filing deadline. What is the e-file rejection grace period for federal tax returns?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content