Your Estate Plan: Don’t Forget About Income Tax Planning

RogerRossmeisl

JULY 16, 2022

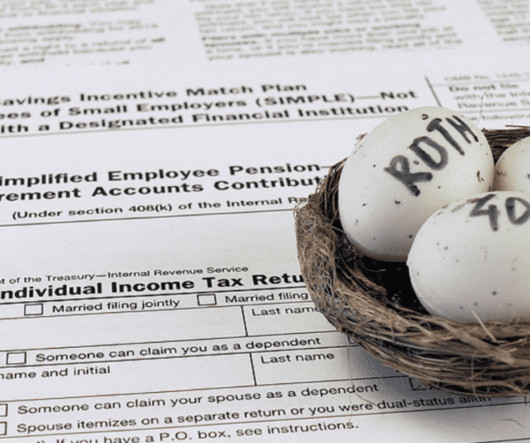

Now, because many estates won’t be subject to estate tax, more planning can be devoted to saving income taxes for your heirs. Note: The federal estate tax exclusion amount is scheduled to sunset at the end of 2025. Beginning on January 1, 2026, the amount is due to be reduced to $5 million, adjusted for inflation.

Let's personalize your content