Choosing the Right Accounting Software

SMBAccountant

JANUARY 5, 2024

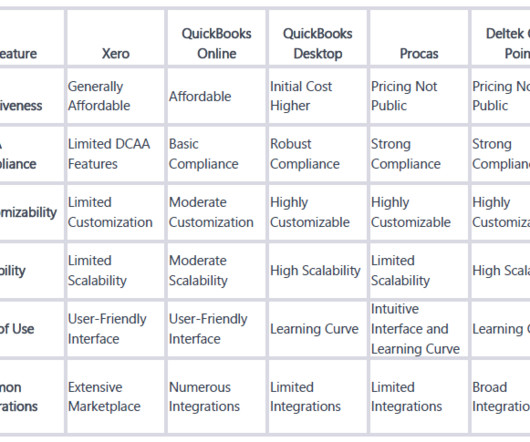

The beginning of a new year also means a fresh start for your Income Statement; which is why now is the perfect time to review your accounting software needs. Accounting may be complicated and time-consuming, especially with spreadsheets. That's why most firms use invoicing and accounting software.

Let's personalize your content