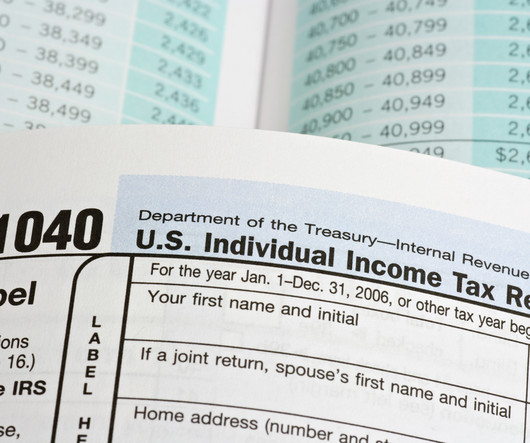

Intuit ProConnect Tax + QuickBooks Online = Timesaving Cloud Solution

CPA Practice

DECEMBER 12, 2023

Accountants using QuickBooks Online know they are getting a solid cloud-based solution to keep their clients’ books. However, when they combine QuickBooks with Intuit ProConnect Tax , they’ll get a more powerful way to manage their clients’ information. ProConnect Tax is well known among tax software.

Let's personalize your content