Survey: Over Half of Accounting Firms Plan to Increase Fees in 2025

CPA Practice

NOVEMBER 20, 2024

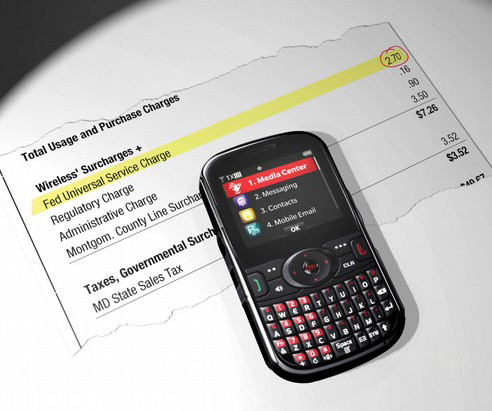

A new report from practice management software provider Ignition says rising business costs are driving fee increases at accounting firms, with 57% planning to raise fees across all services next year. The report also benchmarked current fees for tax, accounting, and advisory services, which varied based on firms’ annual revenue range.

Let's personalize your content