Sales Tax Horror Stories: Audits

TaxConnex

OCTOBER 24, 2023

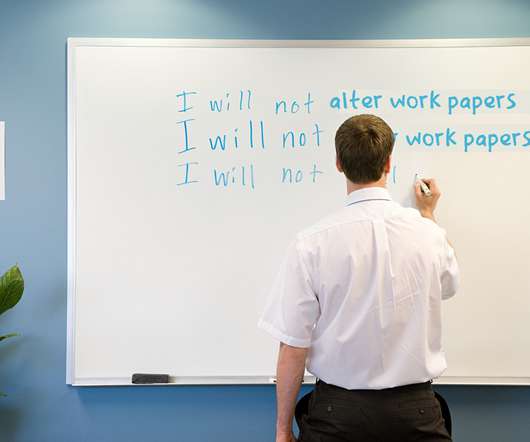

Our third annual survey of financial professionals showed that although most companies (67%) reported that state sales tax audits have remained at the same level over the past two years, almost one in four respondents (23%) said they expect such audits to increase in coming months. Organize your information. Read the notice.

Let's personalize your content