5 Questions to Ask Yourself Before Distributing Sales Tax Obligations to Other Team Members After Losing a Key Employee

TaxConnex

MAY 9, 2023

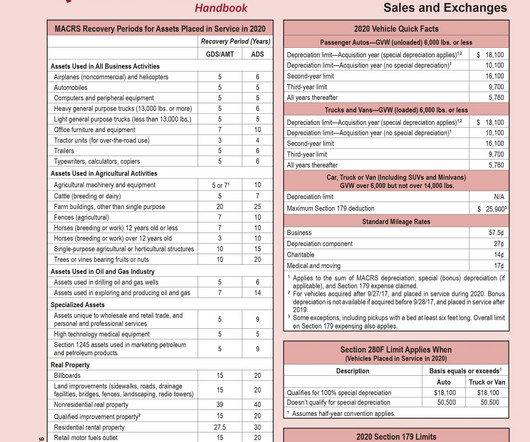

Losing an important member of your finance team can leave a big hole in many business processes, especially if most of your accounting functions are managed in-house. Return Specific Instructions: Document all return specific requirements such as manual adjustments, prepayment calculation methods, and credit reporting.

Let's personalize your content