The Certified Payroll Professional Corner: Penalties

ThomsonReuters

JULY 1, 2022

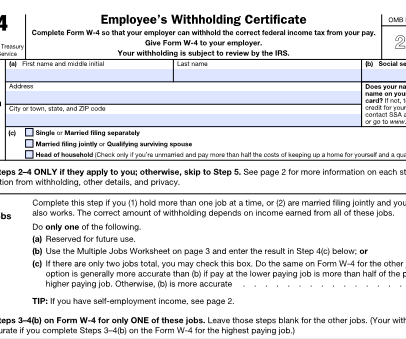

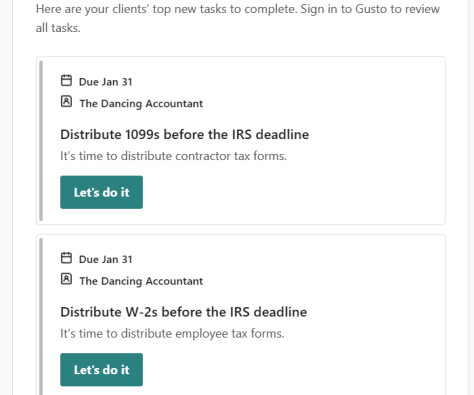

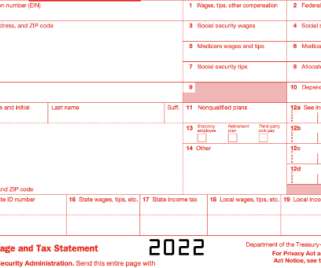

In our last edition of the Certified Payroll Professional (CPP) Corner, we talked about overtime. We asked: “What is the current weekly salary basis for the FLSA exemption from overtime pay?” There are a number of payroll-related penalties that can come from the IRS. Form W-2 filing season.

Let's personalize your content