How To Download Your IRS Account Transcript to Look Up Your Estimated Tax Payments (Updated Jan 2025)

Nancy McClelland, LLC

JANUARY 12, 2025

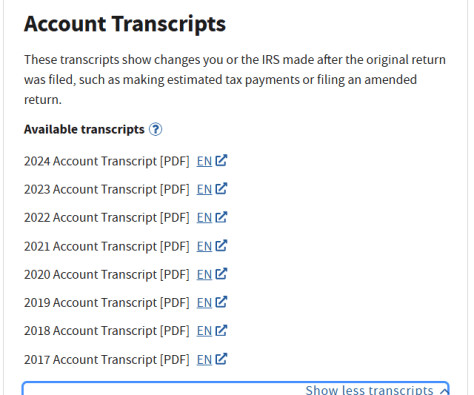

It’s tax time, you’re digging through your records… and your preparer or tax software asks about tax payments you’ve already made. “What is an IRS Account Transcript and Why Do I Need One?” Initially, this was to confirm the amounts of stimulus payments and child tax credit payments.

Let's personalize your content