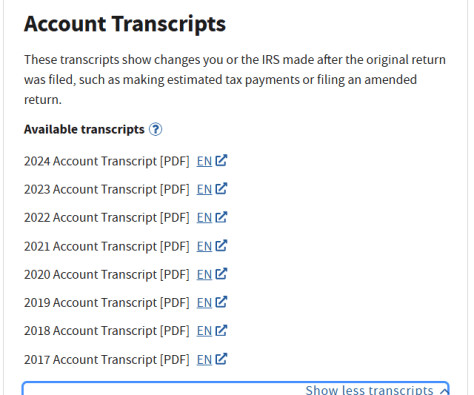

How To Download Your IRS Account Transcript to Look Up Your Estimated Tax Payments (Updated Jan 2025)

Nancy McClelland, LLC

JANUARY 12, 2025

For example, if you’re trying to prepare a tax return for a prior-year and need a list of all the informational documents filed with the IRS that are associated with your SSN, you’d want a Wage & Income Transcript. Tax nerds unite!) “ What About State Information? “Now What Do I Do With These Files?”

Let's personalize your content