What is a notice of assessment and How to Handle a request for information

Ronika Khanna CPA,CA

MAY 26, 2023

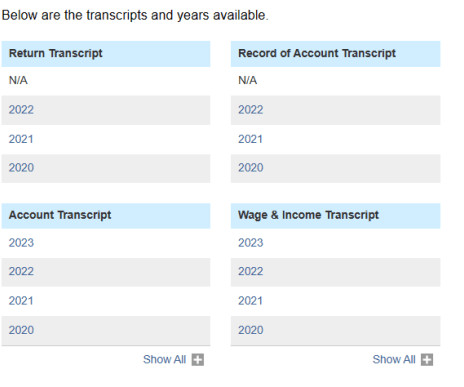

While submitting your tax return is accompanied by a significant sense of relief, one cannot completely relax until you receive the notice of assessment from Revenue Canada (and Revenue Quebec for those of you lucky enough to file two tax returns). It also provides information pertaining to future years.

Let's personalize your content