Employee Retention Tax Credit Penalty Relief

RogerRossmeisl

MARCH 18, 2024

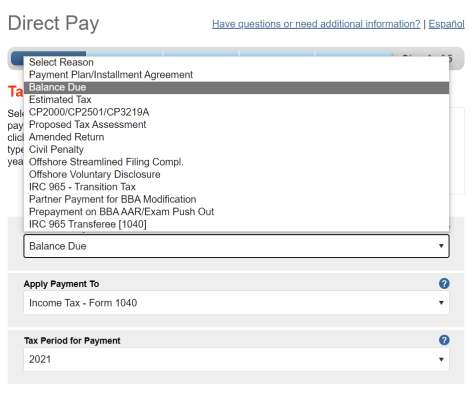

We are finding that, all too often, taxpayers that make Employee Retention Tax Credit (ERTC) claims by engaging a so-called “ERTC Mill” are never told of their responsibility to amend their applicable prior year federal income tax return(s), and are shocked to learn that they owe additional taxes, penalties and interest.

Let's personalize your content