IRS encourages tax pros to adopt a written security plan

Accounting Today

JULY 18, 2023

The Internal Revenue Service wants practitioners, particularly in smaller tax practices, to use a new template to create a data security plan.

Accounting Today

JULY 18, 2023

The Internal Revenue Service wants practitioners, particularly in smaller tax practices, to use a new template to create a data security plan.

BurklandAssociates

JULY 18, 2023

Mitigate the risk of fraud and embezzlement at your startup with these easy to implement financial controls. The post Key Financial Controls for Startups appeared first on Burkland.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TaxConnex

JULY 18, 2023

We hear a lot about nexus and various thresholds but not as much as about tax situs. The situs is the location in which a taxing event occurs. It’s easy to determine when the entire transaction occurs at the point-of-sale but is more difficult when the transaction involves numerous sites. In direct retail, for instance, situs can influence sales tax obligations depending on where the tangible personal property is shipped from in origin states or where it’s shipped to in destination states (learn

Cherry Bekaert

JULY 17, 2023

Everyone is talking about artificial intelligence (AI) these days, but did you know that it has been around for years in back-office settings like IT and finance? However, with the boom created by ChatGPT and generative AI, we’re starting to see applications sprouting up for new front-office settings. In this episode of Cherry Bekaert’s Digital Journeys podcast, Hisham Nabi , Managing Director of Digital Advisory, and Rashaad Balbale , Senior Manager of Strategic Growth and Innovation, will di

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

JULY 19, 2023

By Katelyn Washington, Kiplinger Consumer News Service (TNS) The IRS allocated some of its funding from the Inflation Reduction Act to tax enforcement, and tax-evading millionaires and billionaires are targets. The agency has already closed approximately 175 delinquent tax cases, resulting in a $38 million payday for the U.S. government. With billions of dollars of potential IRS funding on the line (some of which Republican lawmakers have clawed back ), the agency is motivated to continue tax co

Accounting Today

JULY 17, 2023

Today's new partners will be tomorrow's leaders, just as yesterday's new partners are today's leaders.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

RogerRossmeisl

JULY 16, 2023

If you and your employees are traveling for business this summer, there are a number of considerations to keep in mind. Under tax law, in order to claim deductions, you must meet certain requirements for out-of-town business travel within the United States. The rules apply if the business conducted reasonably requires an overnight stay. Note: Under the Tax Cuts and Jobs Act, employees can’t deduct their unreimbursed travel expenses on their own tax returns through 2025.

Accounting Today

JULY 17, 2023

Despite the return to the office following the easing of the COVID pandemic, some accountants who work with nonprofit organizations are still working remotely as well.

Mark Lee

JULY 18, 2023

‘How to deliver advisory services for maximum success’ is the sub-title of a superb new book for accountants that I read recently. I’ll share the author and title later in this post. Let’s just say that I wish I had written this book, as I am already recommending it to accountants, without reservation. In her introduction, the author asks if, like her, you are sick of hearing “compliance is dead” and that all accountants should move into advisory work?

TaxConnex

JULY 20, 2023

Maintaining current, valid exemption certificates is critical in managing your overall sales tax risk. Under audit, an otherwise exempt sale will be deemed taxable without such documentation from a customer – and just a few missing certificates can result in large penalties and interest. Properly documenting exempt sales is a hassle and a pain, but it matters.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

RogerRossmeisl

JULY 16, 2023

You may think you don’t need to make any estate planning moves because of the generous federal estate tax exemption of $12.92 million for 2023 (effectively $25.84 million if you’re married). However, if you have significant assets, you should consider establishing a living trust to avoid probate. Probate is a court-supervised legal process intended to make sure a deceased person’s assets are properly distributed.

Airbase

JULY 19, 2023

For most unicorns, the average time from initial concept to the coveted $1B+ valuation is about seven years. Over that time, these companies go through many rapid stages of evolution. In this often chaotic push for growth, the prime focus is on obvious revenue drivers, like product development and creating a scaled go-to-market motion. Unless they are a hardware company, having an optimum procurement system is not a typical priority in those early growth stages.

MyIRSRelief

JULY 17, 2023

Tax planning is a vital aspect of financial management, both for individuals and businesses. It involves a proactive approach to legally reduce tax liabilities by optimizing financial decisions throughout the year. In this comprehensive guide, we will explore various tax planning techniques and strategies that can empower you to keep more of your hard-earned money while staying in full compliance with the tax laws.

Accounting Today

JULY 21, 2023

The CFO must play a crucial role in determining the strategy and tactics to automate and standardize key processes throughout the organization.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

RogerRossmeisl

JULY 16, 2023

If you’re considering buying a company, fraud may be the last thing on your mind. Unfortunately, you can’t afford to ignore the possibility that your acquisition target is hiding something — possibly something that will have negative financial and legal implications after the deal is complete. To ensure the transaction is what it appears to be, acquaint yourself with the issues and include a forensic accounting expert on your deal team.

Canopy Accounting

JULY 21, 2023

As the accounting industry evolves rapidly, so do the demands on accountants. The relentless pressure to meet deadlines, manage financial complexities, and adapt to technological advancements often takes a toll on their work-life balance. Enduring that imbalance is what often can lead to burnout — which, to the surprise of no one in accounting, 99% of accountants suffer from burnout.

CPA Practice

JULY 21, 2023

Siegel Solutions, a provider of outsourced accounting, and a QuickBooks Solutions Provider, has partnered with NE Paradigm, full-service marketing solutions team. NE Paradigm has been selected as the trusted marketing partner to further enhance Siegel Solutions’ brand presence and expand its reach in the market. By joining forces with NE Paradigm, Siegel Solutions aims to leverage their expertise in strategic marketing, digital advertising, content creation, and brand development.

Accounting Today

JULY 21, 2023

The Internal Revenue Service is seeing a surge of tax scams this summer hitting taxpayers via email and text messages touting tax refunds and quick fixes to their tax problems.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

RogerRossmeisl

JULY 16, 2023

High-income taxpayers face a regular income tax rate of 35% or 37%. And they may also have to pay a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. Fortunately, there are some ways you may be able to reduce its impact. Affected taxpayers The NIIT applies to you only if modified adjusted gross income (MAGI) exceeds: $250,000 for married taxpayers filing jointly and surviving spouses, $125,000 for married taxpayers filing separately, $200,000 for unmarried t

Patriot Software

JULY 21, 2023

At some point, one of your employees may need to take time off before and after giving birth. You must create and implement a maternity leave policy before that happens. But before you can establish your policy, familiarize yourself with and comply with maternity leave laws. What is maternity leave?

Withum

JULY 21, 2023

The IRS released a general legal advice memorandum, or GLAM, addressing the employee retention credit (ERC) and supply chain disruptions on July 20, 2023. The GLAM discusses five scenarios where taxpayers might qualify for the ERC on the basis of a supply chain disruption, and then it dismisses each of the claims in order. While the specific principles that can be distilled from the GLAM are discussed below, we believe it is telling that the IRS issued a pronouncement on supply chain disruptions

Going Concern

JULY 21, 2023

Footnotes is a collection of stories from around the accounting profession curated by actual humans and published every Friday at 5pm Eastern. While you’re here, subscribe to our newsletter to get the week’s top stories in your inbox every Tuesday and Friday. See ya. News Battle accountancy firm urges others to offer opportunities to Ukrainian professionals after successful placement [ SussexWorld via Yahoo!

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

CPA Practice

JULY 21, 2023

By Angela Ruth, Kiplinger Consumer News Service (TNS) Small businesses have a huge economic impact in the United States. Today, they account for 99.9% of all companies , according to the U.S. Chamber of Commerce. As such, they’re major contributors to the economy. However, it’s not always easy to be a smaller player. When you’re the head of a small business, you’re constantly consumed by the need to steward your finances.

Accounting Today

JULY 20, 2023

Recently appointed the president of the Information Technology Alliance, Geni Whitehouse wants to be a bridge between small and middle-market businesses.

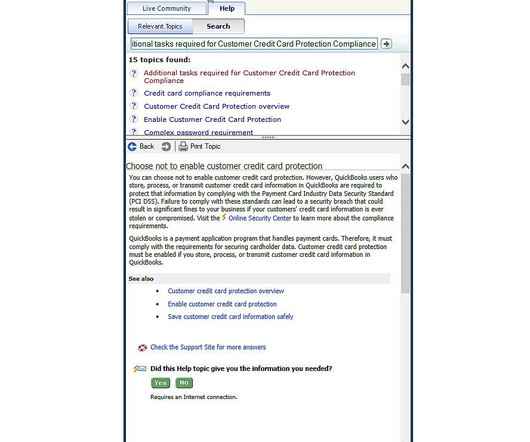

Insightful Accountant

JULY 18, 2023

The newest email from Intuit QuickBooks is a Final Reminder to Become PCI Compliant Today. I have one and don't even have an active Payments Account.

Going Concern

JULY 19, 2023

Hong Kong is suffering from “a serious talent shortage” according to an article today in South China Morning Post and The Hong Kong Association of Registered Public Interest Entity Auditors (PIEAA) says accounting firms should start looking overseas. Who knows, maybe they’ll find a hidden cache of accountants and auditors stashed away on North Sentinel Island.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

CPA Practice

JULY 20, 2023

A Top Technology Initiative Article. June 2023. With the spring conference season wrapping up, watching the frenzy around Artificial Intelligence (AI) and its applicability in the profession has been amazing. As noted in my April column , there are various innovative uses of AI and privacy risks for your client data. Recently, Google released its SAIF (Secure AI Framework) regulations based on six principles to enable the creation of high-quality, secure artificial intelligence.

Accounting Today

JULY 20, 2023

Recent data says that companies spent significantly more on software over the past year, with finance departments' spending in particular seeing major spikes.

Nancy McClelland, LLC

JULY 16, 2023

Nancy modeling at the Beehive In Bloom Fashion Show | photo by Zak Jacobson It’s not often I am described as either brilliant or insightful — so it’s a banner day when referred to as both. And what better day than today, the 22nd anniversary of starting my own accounting firm? To celebrate, I am delighted to share a recent interview with CanvasRebel , an online magazine and podcast that highlights voices of small business owners — in their words, “stories about our

Going Concern

JULY 19, 2023

Milwaukee’s Wipfli — one of the only top 25 firms on Accounting Today’s 2023 Top 100 to have lost partners — announced on Monday it has entered into a merger agreement with Clayton & McKervey, the itty bitty Southfield, MI firm we mentioned in January for their partnership with Adrian College to help unlicensed staff pursue a master’s.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content