6 opportunities every firm should consider

Accounting Today

MARCH 11, 2024

With a wealth of ways to move forward and build their practices, accounting firms need to figure of which to take, and which to pass up.

Accounting Today

MARCH 11, 2024

With a wealth of ways to move forward and build their practices, accounting firms need to figure of which to take, and which to pass up.

Insightful Accountant

MARCH 11, 2024

A judge ruled the Corporate Transparency Act's ownership reporting unconstitutional for NSBA and its 60,000+ members by March 1, 2024. This may trigger similar cases nationwide, impacting BOI reporting. Practitioners need to plan their response.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Dent Moses

MARCH 13, 2024

In today’s business environment, companies are constantly seeking ways to optimize operations and enhance efficiency. One strategy gaining prominence is outsourcing, particularly accounting functions. Outsourcing accounting services can offer a myriad of benefits, revolutionizing a business’s financial landscape. Firstly, outsourcing allows companies to tap into a pool of skilled professionals without the burden of hiring and training in-house staff.

TaxConnex

MARCH 12, 2024

Since the first adding machine showed up on counters to help shopkeepers tack on the correct sales tax, automation has been part of compliance. Now the buttons and the lever have given way to behind-the-scenes software and automatic functionality. Good thing, too, as sales tax has evolved beyond a static percentage to involve thousands of tax jurisdictions and ever-changing calculations.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Canopy Accounting

MARCH 11, 2024

Have questions about accounting practice management software? We cover it all here. Learn what it is, how to use it, and much more!

Patriot Software

MARCH 13, 2024

Machine learning (ML), a branch of artificial intelligence (AI), is everywhere. It has transformed online shopping (“users also bought…”) and TV streaming (“because you watched…”). Machine learning has also revolutionized the field of accounting. Machine learning in accounting has made financial management more streamlined, accurate, and insightful.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

MARCH 11, 2024

The fate of the Child Tax Credit is in the hands of the Senate, but the IRS is ready to implement changes rapidly if the bill is passed.

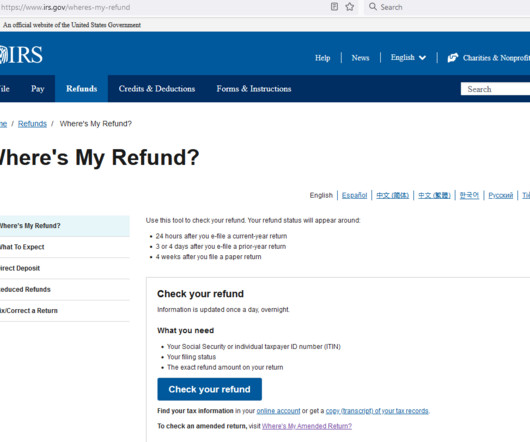

Accounting Today

MARCH 12, 2024

Despite a later start, tax filing is proceeding apace — though there are some unresolved issues.

CPA Practice

MARCH 11, 2024

By Dave Eisenstadter, masslive.com (TNS) Did you end up unexpectedly owing money on your taxes this year? Statistics from the IRS ending on March 1 indicate you’re not alone. Compared with a similar point in the tax season the previous year, there have been nearly 6 million fewer refunds, IRS records show. By March 3, 2023, 42,040,000 refunds had been issued compared with 36,288,000 by March 1 of this year, a difference of 5.75 million or nearly 14%.

BurklandAssociates

MARCH 12, 2024

Clean Energy startups and other grant recipients have all the usual accounting requirements, plus additional grant compliance responsibilities. The post Grant Compliance 101 for Startups appeared first on Burkland.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

MyIRSRelief

MARCH 15, 2024

In the bustling city of Whittier, California, individuals and businesses alike face the daunting task of navigating the complex world of taxes. From unfiled tax returns to unpaid back taxes, and from employment 941 payroll issues to the intimidating process of IRS, FTB, EDD, and CDTFA audits, the challenges can seem insurmountable. However, tax relief services offer a beacon of hope, providing expert guidance and support to those in immediate need.

Accounting Today

MARCH 12, 2024

The pilot program is expanding in the 12 states where it's available.

Acterys

MARCH 13, 2024

Navigating Corporate Performance Management (CPM) needs has become a strategic force for businesses eager to harness data for insightful decision-making. To cater to the evolving needs of SMBs and enterprises, Acterys has emerged as a distinguished accelerator in the 2024 CPM Technology Value Matrix by Nucleus Research, showcasing its innovative approach to integrating analytics and planning.

Going Concern

MARCH 13, 2024

*Technically the partners are being forced to retire but the headline was already way too many characters It’s been more than a year since Australian Financial Review blew the PwC Australia tax scandal wide open and it’s been nothing but migraines for PwC leadership (and their cousins at other Big 4 firms also subject to relentless grilling by Aussie senators) since.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

MARCH 15, 2024

The Internal Revenue Service continues to increase the amount of information available in multiple languages. Although the primary language of the agency is usually expressed in dollar signs followed by numbers and commas, the agency offers a variety of support tools to help people across multiple languages. The agency’s multilingual efforts are a part of its Strategic Operating Plan, which has received additional funding since the enactment of the Inflation Reduction Act.

Accounting Today

MARCH 12, 2024

While every company is different, there are 12 operational areas distressed businesses often miss, which can foretell a deteriorating financial condition.

Withum

MARCH 14, 2024

Explore Other Episodes #CivicWarriors #WithumImpact The post Let’s Help Promote Collaboration With NJ Association of Community Providers appeared first on Withum.

Going Concern

MARCH 15, 2024

Footnotes is a collection of stories from around the accounting profession curated by actual humans and published every Friday at 5pm Eastern. While you’re here, subscribe to our newsletter to get the week’s top stories in your inbox every Tuesday and Friday. Comments are closed on Friday Footnotes and the Monday Morning Accounting News Brief by default.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CPA Practice

MARCH 15, 2024

The Internal Revenue Service has renewed its message for businesses to review the Employee Retention Credit guidelines to avoid future compliance action for improper claims. Amid aggressive marketing that misled many businesses into filing claims for ERC, the IRS has sharply increased compliance action through audits and criminal investigations – with more activity planned in the future.

Accounting Today

MARCH 14, 2024

Zach Donah, the new CEO of the Massachusetts Society of CPAs has big plans for the organization.

AccountingDepartment

MARCH 14, 2024

How an ERP system, such as Netsuite, tailored for the unique needs of SMBs, can be a pivotal tool in propelling small businesses to new heights.

Going Concern

MARCH 9, 2024

Are the kids not alright? That’s the question posed by this recent r/Big4 post. Two themes repeatedly emerge from the comments: The early-career busy work has been outsourced away and this is the inevitable result The pay is too low and workload too high, new hires are wise not to bust their asses for the firm given these two facts And a third factor: Young people have always been kind of dumb and OP probably forgot how dumb they were when they were an associate.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CPA Practice

MARCH 12, 2024

By Zina Hutton, Governing (TNS) No one likes paying taxes and property taxes are always the least popular. Some lawmakers are now looking to eliminate them entirely, with anti-tax initiatives also being proposed for this year’s ballots. Home prices have skyrocketed over the past few years, with prices in places like Idaho rising upward of 50%. In Idaho, that may largely be the result of remote work bringing more coastal transplants.

Accounting Today

MARCH 15, 2024

Private equity firm New Mountain Capital is taking a majority stake in Grant Thornton in the biggest deal to come along in PE firms' involvement in the accounting field.

Randal DeHart

MARCH 15, 2024

Customer service is the heartbeat of any successful business. The unsung hero transforms a potential disaster into an opportunity and a mere transaction into a lifelong relationship. In the narrative of customer loyalty and retention, service is the protagonist. Your approach to customer service has the power to attract and retain clients. As a construction business owner, client service is critical to your company's success.

Going Concern

MARCH 12, 2024

Across the pond, Big 4 firms are struggling to generate deals business in this lackluster economy and as expected this has led to some cuts. KPMG let 6 percent of their deals people go in October, up to 600 people at PwC were asked to leave or get fired in November, and 150 more people were punted out of EY just days before Christmas on top of the five percent of the 2,300 people in financial services consulting chopped in August.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CPA Practice

MARCH 13, 2024

By Alex Baulf. In the midst of the accounting profession entering a brave new world where digitization of tax and accounting processes is increasingly the norm, it should come as no surprise that the humble invoice is now in the crosshairs of governments around the globe, including the U.S. The invoice is essential to tax compliance processes, and the electronic invoice (e-invoice) is not only inevitable, but upon us.

Accounting Today

MARCH 13, 2024

Affected businesses may turn to their accountants for help, but are firms the best source to help clients report beneficial ownership information to the feds?

GrowthForceBlog

MARCH 12, 2024

9 min read Nonprofit organizations do not pay taxes, so they are not subject to audits performed by the Internal Revenue Service. Audits, however, are still sometimes required for nonprofit organizations by federal, state, or local entities.

Going Concern

MARCH 13, 2024

BDO USA filed a federal trade secrets lawsuit against Ankura Consulting on Monday that alleges Ankura “unjustly enriched itself through the employee defections from BDO and stole the company’s confidential information.” The defections came in the form of several senior-level staff from BDO’s healthcare transaction advisory business who apparently left BDO with their national practice leader.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content