Bigger than Accounting: How Accountants Can Guide Clients to Financial Success this Holiday Season

Insightful Accountant

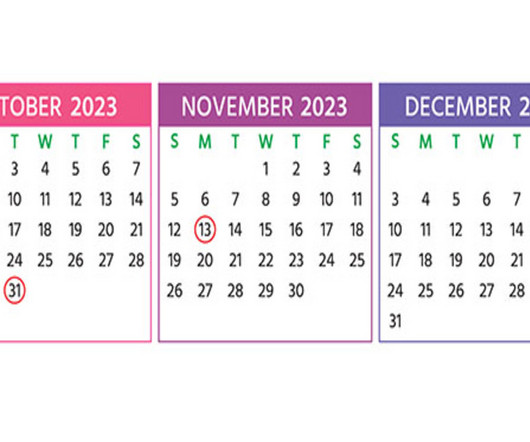

NOVEMBER 6, 2023

For most people, this time of year is synonymous with joy, festivities, and of course, holiday shopping. However, for business owners and individuals alike, it can also be a season of financial stress and anxiety.

Let's personalize your content