Becoming an Accounting Firm of the Future: The Benefits of Embracing New Technology

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

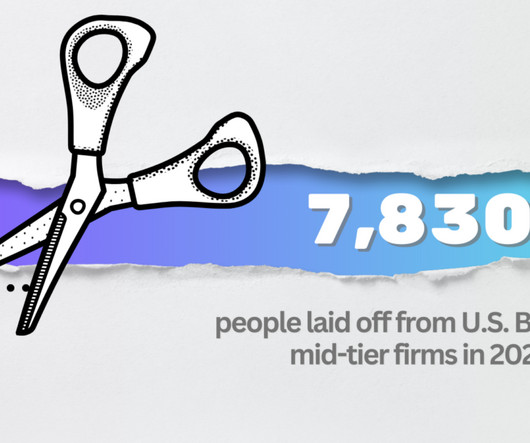

Going Concern

DECEMBER 27, 2023

Today is December 27, assuming there is no accounting firm in the entire country shitty enough to lay people off just days before the end of the year (a generous assumption), we should be able to tally up how many people were shown the door in 2023. These are U.S. numbers for Big 4 and mid-tier firms only, if we missed some get in touch. Also, these layoff numbers include only layoffs that were A) confirmed and B) counted by the firm as layoffs, meaning this year’s aggressive PIP usage and

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AccountingDepartment

DECEMBER 26, 2023

Small and medium-sized businesses (SMBs) are essential to the economy, accounting for more than half of all jobs worldwide. In recent years, several trends have impacted how SMBs operate, and we can expect even more changes to come in 2024. To prepare for the future, businesses must be aware of these shifts and adapt accordingly. In this blog post, we will discuss five SMB trends that we can expect to see in 2024, dealing with AI, customer experience, sustainability, and cybersecurity.

CPA Practice

DECEMBER 27, 2023

By Adam Lean, Co-Founder & CEO, The CFO Project. In my role as CEO of The CFO Project , a community that helps accountants start and scale CFO/Advisory practices, I’ve noticed that many accounting and bookkeeping firm owners are stuck in what we call The Accountant’s Trap. What is the Accountant’s Trap you might ask? It’s where financial professionals are trapped working long hours for low fees, are forced to deal with high-demanding clients,while being burnt out on compliance and transactio

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

DECEMBER 26, 2023

The Internal Revenue Service is not expected to meet the Treasury Department's goal of scanning millions of returns by the end of the year.

Insightful Accountant

DECEMBER 27, 2023

One less excuse for Desktop Users when it comes to migrating to QBO. There is now Balance Sheet Budgeting available in QBO Plus and QBO Advanced.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

DECEMBER 27, 2023

Here's how artificial will really impact accountants and what to do about it.

Going Concern

DECEMBER 26, 2023

The following post about a rowdy accounting firm holiday party was originally published on December 17, 2014. For more reading on holiday parties of yore, see this r/accounting thread from six years ago: Christmas Party Stories. My Firm Holiday Party is a Teaching Moment For What Not to Do at a Firm Holiday Party By Leona May One year at my firm, we had a Christmas party at the nicest hotel in the city.

Accounting Today

DECEMBER 26, 2023

The bottom state in the ranking received a total score for financial literacy of 51 out of 100.

TaxConnex

DECEMBER 28, 2023

The new year will no doubt be another active one in sales tax. Let’s look at a few of the likeliest developments. Weaker state revenue The kind of year it’s going to be for state coffers could greatly influence such future sales tax trends as new levies, tougher nexus thresholds and intensifying audits. If so, watch out for 2024. “With more fiscal data coming in, the long-term health of state budgets looks murky,” writes analyst Lucy Dadayan on the site of the Tax Policy Center.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

BurklandAssociates

DECEMBER 26, 2023

Thank you to all the experts throughout the startup ecosystem who joined our Startup Success podcast in 2023 to share knowledge and insights. The post Listeners’ Favorites: Our Top Podcast Episodes of 2023 appeared first on Burkland.

MyIRSRelief

DECEMBER 29, 2023

Employment taxes can be a complex area for businesses, especially when it comes to Form 941, the Employer’s Quarterly Federal Tax Return. This form is used to report income taxes, social security tax, or Medicare tax withheld from employee’s paychecks, and to pay the employer’s portion of social security or Medicare tax. However, mistakes can happen, and when they do, they can lead to significant tax problems.

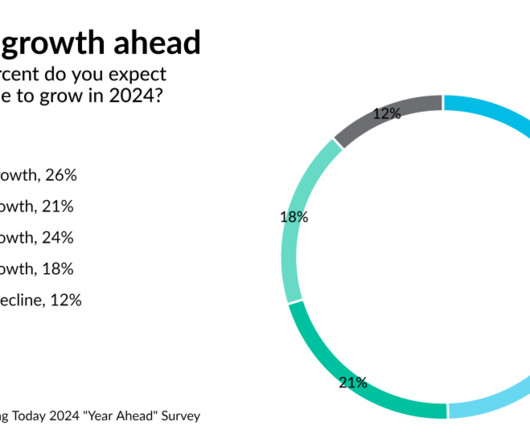

Accounting Today

DECEMBER 29, 2023

Accounting Today's annual survey reveals firms' expectations, worries and plans for the next 12 months.

Going Concern

DECEMBER 28, 2023

I’m breaking my holiday vacation with this news: Attention all CPA Exam Candidates… pic.twitter.com/YwBD3uym2l — NASBA (@NASBA) December 27, 2023 Make sure you check out the comments. The funniest part is they posted this on Tuesday like everything was going to be normal: #CPAExam candidates! Waiting for your score(s)? They will be released tonight at 7 p.m.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

DECEMBER 28, 2023

By Christopher Stark, Founder & CEO, Cetrom. ChatGPT ushered in a new era of automation in accounting (link goes to YouTube), for better or worse. While technology has made many content-based tasks much easier, questions remain about its accuracy and security. This machine learning-powered chatbot with the GPT-3 engine at its core has captivated people’s attention with its rapidly evolving ability to interpret questions and commands to produce generally coherent natural-language responses.

Randal DeHart

DECEMBER 29, 2023

To be in business and to remain in business, become a business person! To run a business, you must be business-like. It's not sufficient just to be very good at what you do. Many people who are 'very good at what they do' have failed. The familiar cry: "I'm far too busy for that" is no excuse. Are you 'too busy' to be a competent businessperson? If so, your construction business won't last long.

Accounting Today

DECEMBER 27, 2023

Technology developers who serve the accounting profession share the developments they have planned for 2024.

Going Concern

DECEMBER 29, 2023

It’s here! The barely anticipated year-end phoning in of content look back on what news was important to Going Concern readers and Google visitors in 2023. This ranking is derived from analytics data thus is more trustworthy than the editorial team trying to remember what story was big back in March. While you’re here, let us say thanks for reading and we’ll see you in 2024.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CPA Practice

DECEMBER 29, 2023

In the 2024 presidential election year, you may have another important election to consider, although this one is on your personal tax return. Depending on your situation, you might elect to forgo preferential tax treatment on certain long-term capital gains and qualified dividends in favor of deducting investment interest expenses. Background : Generally, the tax law allows you to deduct the investment interest expenses you incur during the year—for example, when you buy stock on margin— but on

CTP

DECEMBER 28, 2023

If you are working with a company that sells goods made in the U.S. in foreign markets, you may want to introduce this lucrative tax incentive: the interest charge domestic international sales corporation, more commonly known as the “IC-DISC.” Geared specifically toward American exporters, this incentive helps companies become more globally competitive by lowering their U.S. taxes.

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service's Exempt Organizations and Government Entities unit has published two new technical guides aimed at nonprofits.

Going Concern

DECEMBER 25, 2023

It’s Christmas, why are you even here? THERE’S NO ACCOUNTING NEWS. Now go forth and be merry. Love, GC p.s. if your nieces or nephews mention Skibidi Toilet at dinner tonight do yourself a favor and don’t Google it. I’ve been stuck in a YouTube hole for the last two days, send help. The post A Brief Message From Santa appeared first on Going Concern.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Ace Cloud Hosting

DECEMBER 26, 2023

Tax preparation can be a daunting task, especially for those new to the field. Lacerte Software offers a comprehensive solution that simplifies the process and ensures accuracy and compliance. Lacerte.

CPA Practice

DECEMBER 25, 2023

Organizations have increasingly been drawn into societal conversations around social change, and are often expected by some to take action, while others may express irritation at such moves by businesses. But according to a new survey from The Conference Board, fewer than half of U.S. workers (44%) are satisfied with their organization’s response to social change issues like racism and gun violence.

Accounting Today

DECEMBER 26, 2023

Federal money is keeping construction businesses busy, but comes with its own complications.

AccountingDepartment

DECEMBER 29, 2023

We are thrilled to announce that Episode 9 of our podcast, Beyond the Books , is now live and ready for your listening pleasure.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Patriot Software

DECEMBER 29, 2023

Aggressive promotion, scams, and ERC mills—that’s the drama surrounding the employee retention credit (ERC). The ERC was a lifeline for small businesses struggling to stay open during the pandemic. But bad actors quickly pounced on the opportunity.

Ace Cloud Hosting

DECEMBER 27, 2023

Discover responses to frequently asked QuickBooks hosting queries from users and additional resources. Are you curious about QuickBooks hosting and wondering if it suits your business? You’re not alone! Explore.

Accounting Today

DECEMBER 29, 2023

The Internal Revenue Service and Treasury plan to propose regulations on a requirement for a product identification number, and they're asking for comments ahead of time on the PIN requirement.

AccountingDepartment

DECEMBER 28, 2023

Each year, our team gears up to attend events all over the United States that AccountingDepartment.com proudly sponsors. As a proud supporter of Vistage International, Entrepreneurs’ Org, EOS Worldwide, CEO Coaching International, Genius Network, Small Giants Summit, HubZone, Women Presidents’ Organization, and B2B CFO®, our team gets to experience many great events, meet many amazing people, and see our clients from all over.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content