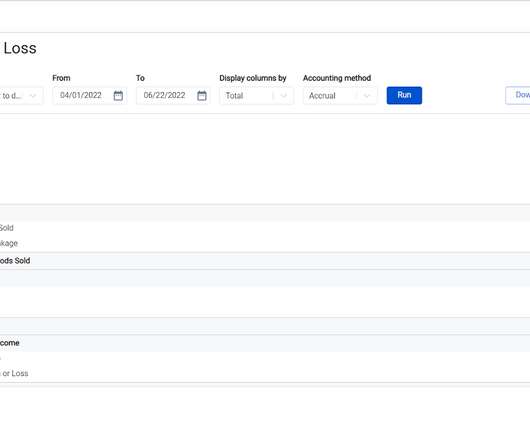

A Complete Guide to Reading Financial Statements

xendoo

NOVEMBER 29, 2021

With little experience in reading financial statements, this request makes you freeze in your tracks, uncertain of how to express the success of your growing business. If this scenario sounds in any way relatable, it’s time to become more familiar with the process of reading financial statements. Cash flow statements.

Let's personalize your content