Form 990: A Guide for Accountants Working with Non-Profit Organizations

Canopy Accounting

OCTOBER 6, 2023

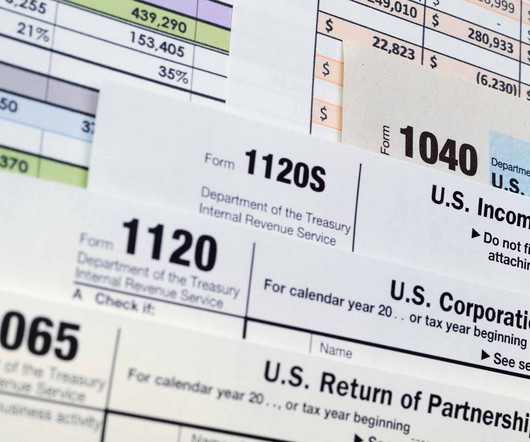

As accountants, working with non-profit organizations requires a deep understanding of specific financial reporting requirements. One of the critical documents that demands attention is Form 990 - Return of Organization Exempt from Income Tax.

Let's personalize your content