Payroll Taxes vs. Income Taxes | What’s the Difference Between Payroll and Income Tax?

LyfeAccounting

NOVEMBER 17, 2020

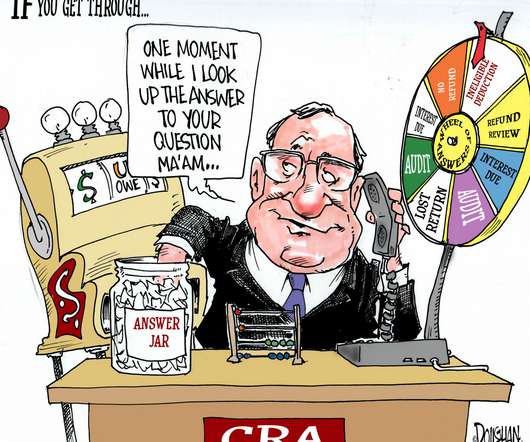

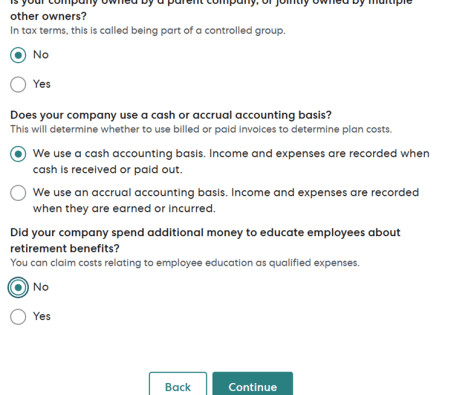

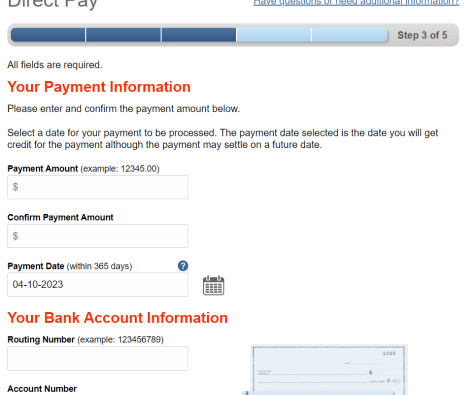

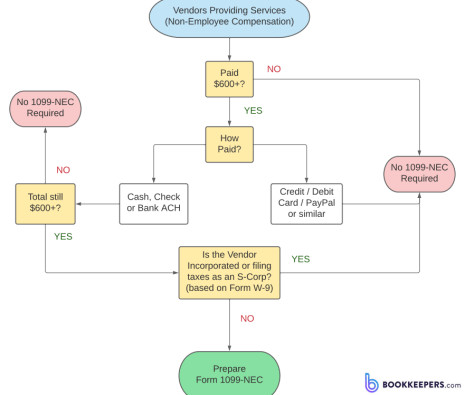

Like, literally, I paid my payroll taxes one-day late by accident, the IRS sent me a penalty for over $1,000. In addition, I didn’t know the requirements of income taxes, especially for self-employed individuals. In this post, I’m going to fully explain the difference between payroll taxes and income taxes.

Let's personalize your content