Automation’s place in compliance

TaxConnex

MARCH 12, 2024

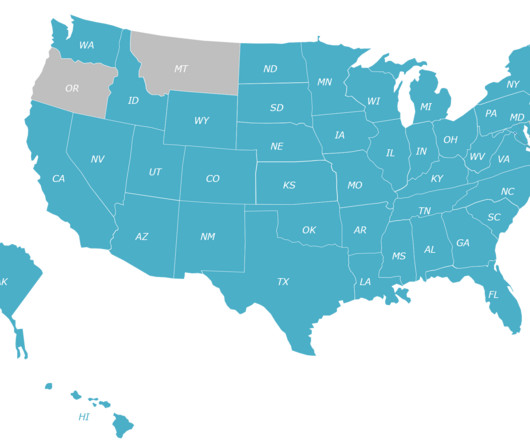

Since the first adding machine showed up on counters to help shopkeepers tack on the correct sales tax, automation has been part of compliance. Good thing, too, as sales tax has evolved beyond a static percentage to involve thousands of tax jurisdictions and ever-changing calculations.

Let's personalize your content