Section 174 Research & Software Development Costs – A Guide to Compliance

Cherry Bekaert

MARCH 14, 2023

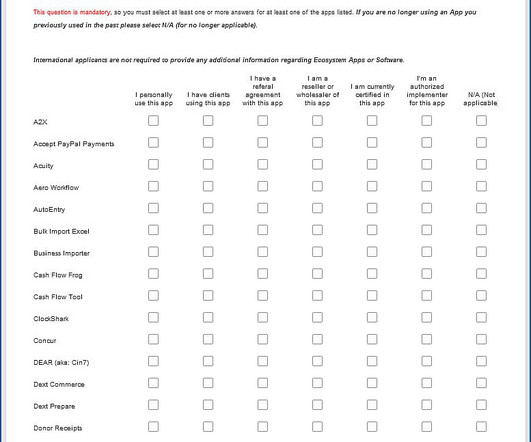

For tax years beginning in 2022, Internal Revenue Code Section 174 (Sect. Join leaders from the Cherry Bekaert Tax Credits & Incentives Advisory team as we answer these questions and cover: Define research and experimentation and software development qualifying expenses Discuss what is not considered Sect.

Let's personalize your content