IRS adds crypto question to more tax forms

Accounting Today

JANUARY 22, 2024

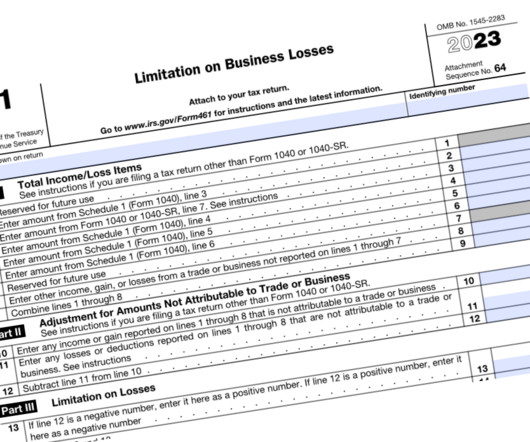

The Internal Revenue Service has revised the question it has asked in recent years about income from digital assets such as cryptocurrency on the Form 1040 for individual taxpayers this tax season and added it for the first time to tax forms for estates, trusts, partnerships and C and S corporations.

Let's personalize your content