Work from anywhere with these new updates to our Xero apps

Xero

APRIL 11, 2023

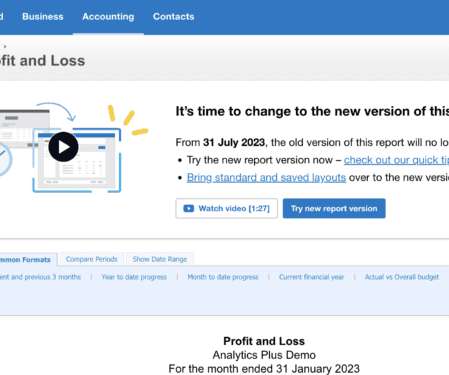

Know where your business stands at a glance The Xero Accounting app helps you stay productive while away from the desk, by giving you the key financial information you need on the go. It means you spend less time chasing staff for information, and have the information you need to reimburse expenses and do accurate pay runs.

Let's personalize your content