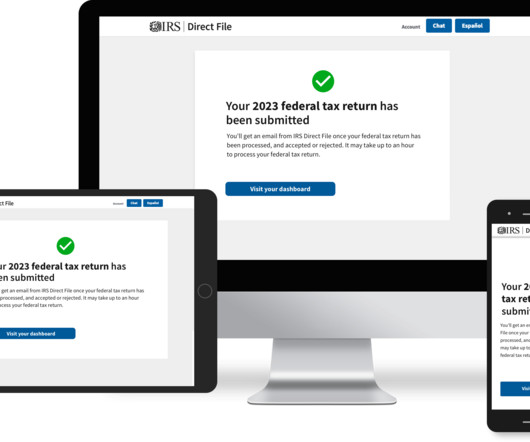

IRS Direct File Pilot Reaches Final Testing Phase

CPA Practice

MARCH 4, 2024

Taxpayers can now learn if they’re eligible to use the Direct File pilot program to file their 2023 tax return on the IRS website , which contains an easy step-by-step guide to help walk them through the process.

Let's personalize your content