Professional Tax Help in New York: Taxpayers Facing Tax Audits, Back Taxes, and 941 Payroll Tax Problems

MyIRSRelief

MAY 19, 2023

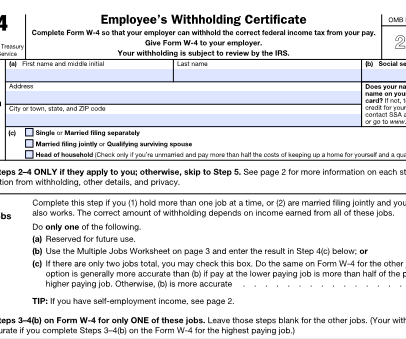

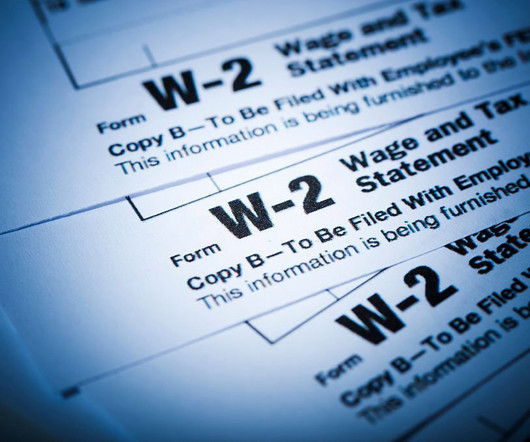

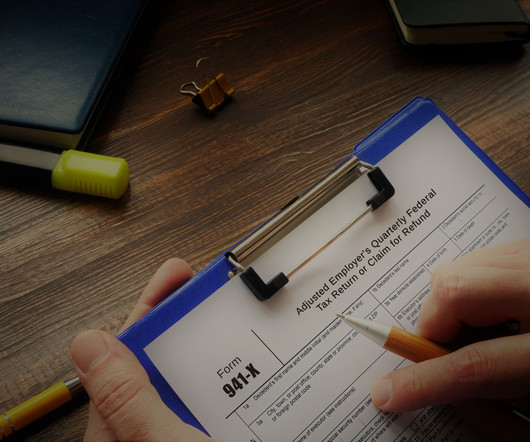

With this bustling economy comes a complex tax system, which can be overwhelming and confusing for many taxpayers. Whether you are a small business owner, self-employed, or an individual taxpayer, you may face tax issues such as tax audits, back taxes, and 941 payroll tax problems.

Let's personalize your content