Tax Preparation Checklist for Startups

BurklandAssociates

DECEMBER 7, 2022

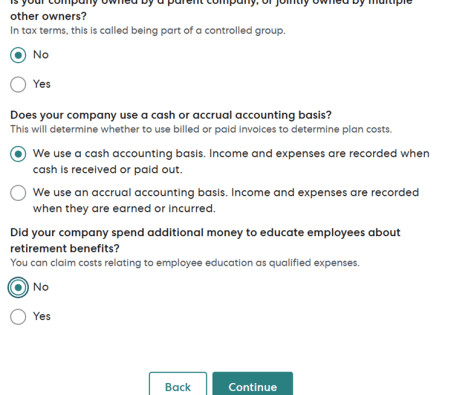

Use this tax preparation checklist for startups to collect the information and documents your tax professional will need to prepare your 2022 taxes. The post Tax Preparation Checklist for Startups appeared first on Burkland.

Let's personalize your content