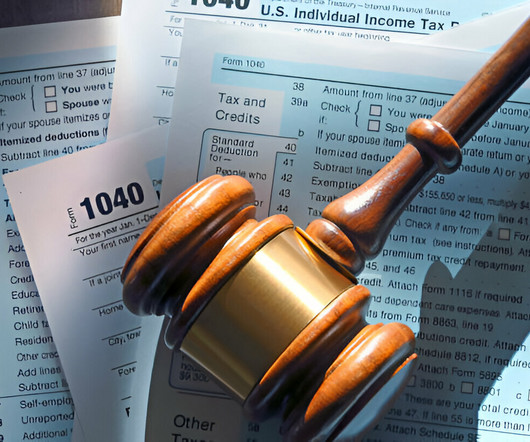

Deduct a Loss from Making a Personal Loan to a Relative or Friend

RogerRossmeisl

APRIL 27, 2025

Thats a nice thought, but there are tax implications that you should understand and take into account. For federal income tax purposes, losses from personal loans are classified as short-term capital losses.

Let's personalize your content