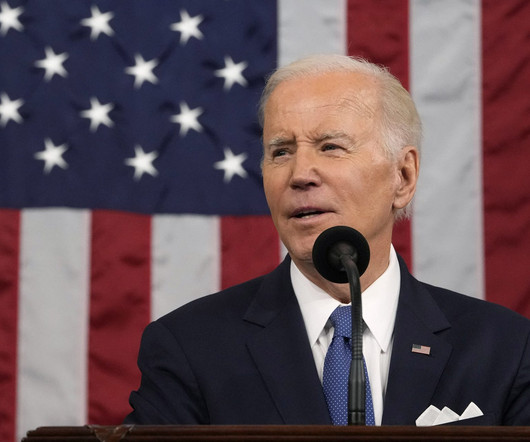

Biden Will Push Higher Taxes For the Wealthy in State of the Union

CPA Practice

MARCH 4, 2024

While it’s unclear if Biden will mention it in the speech, Republicans have been on the defensive over a recent Alabama Supreme Court ruling that frozen human embryos can be considered people under state law. Republicans, who abhor any tax increase, narrowly control the House and Democrats have a slender hold over the Senate.

Let's personalize your content