Two-thirds of clients ready to change auditors

Accounting Today

JUNE 9, 2025

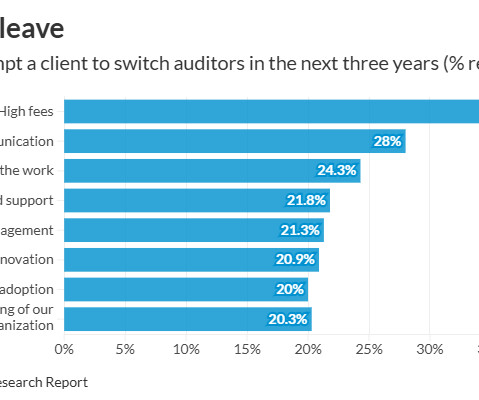

Businesses" report found that 34% of respondents said they are "very likely" to switch auditors in the next three years, 36% are "somewhat likely" and 15% are "not sure." Gary Boomer June 9 Audit Two-thirds of clients ready to change auditors Seventy percent of U.S. Inflos "Creating a New Audit Experience for U.S.

Let's personalize your content