When do I have to start collecting out of state sales tax? Part 1

TaxConnex

JULY 19, 2022

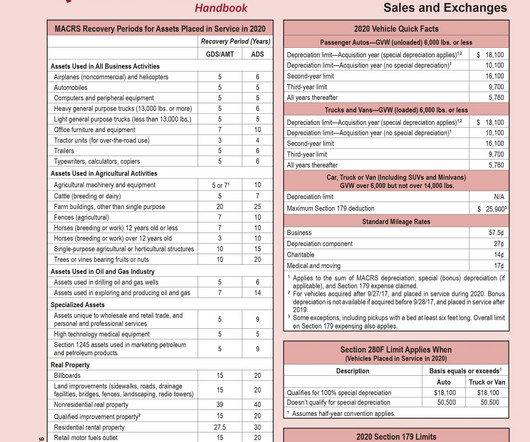

In the meantime, your business may have to start collecting and remitting states’ sales tax – with severe penalties if you don’t. You can create it in a state by having a store or office space there – or often simply by having sales or service reps do business in the state.). What’s taxable? Other products and?solutions?can

Let's personalize your content