Rules for When To Issue a 1099 Form to a Vendor – Updated for 2023

Nancy McClelland, LLC

DECEMBER 26, 2023

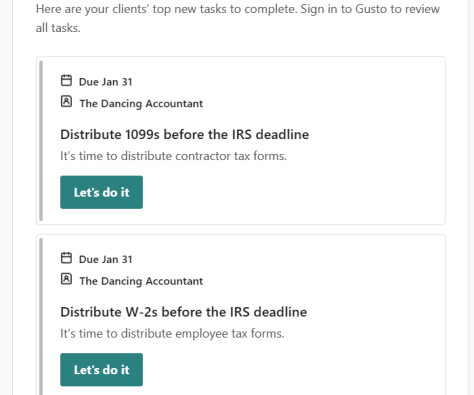

As is the case every year, we’re hearing from lots of folks confused about when to send a 1099 form or other “information returns” to someone. It is true that over time, these forms have continued to change, and the rules have become more specific… but the basics remain the same. NEC” stands for “non-employee compensation”.

Let's personalize your content