Understanding depreciation and its impact on corporate tax

ThomsonReuters

AUGUST 25, 2023

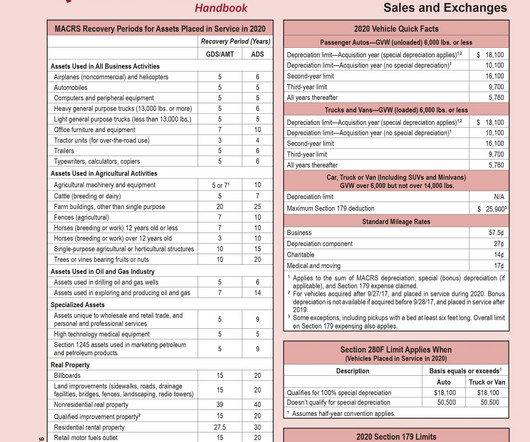

What is the purpose of making a provision for depreciation? What is the depreciation guidance for corporate alternative minimum tax? Having a clear understanding of corporation tax depreciation can help accounting professionals better serve their clients. What is the purpose of making a provision for depreciation?

Let's personalize your content