Payroll errors and how to avoid them

ThomsonReuters

APRIL 18, 2023

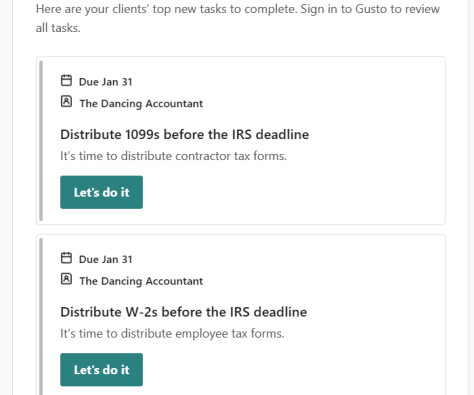

For business owners, payroll is complex and often their greatest expense. For accounting professionals, payroll services have long been viewed as a time-consuming, high-risk loss leader. Payroll errors are certainly a real concern, but with the right tools and resources in place, payroll services can be a growth opportunity for firms.

Let's personalize your content