Partnership Income Tax Returns & More Skagit County IRS Targets

SkagitCountyTaxServices

NOVEMBER 8, 2023

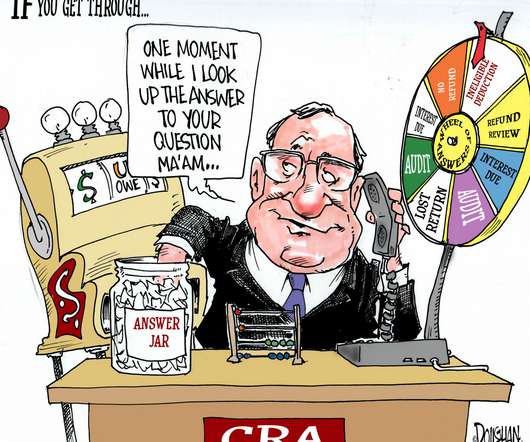

For you as a business owner, besides jumping on opportunities, you’ll also want to stay abreast of things that might affect your business with Uncle Sam. The IRS will be focused less on working-class taxpayers and increasingly toward high-income individuals and corporations.

Let's personalize your content