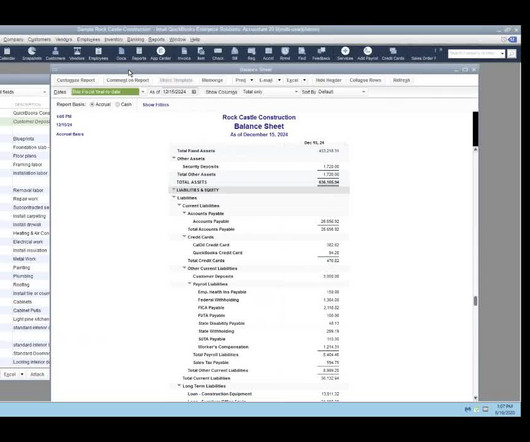

QuickBooks Connect: Everything You Need to Know

Ryan Lazanis

JUNE 6, 2022

QuickBooks Connect is one of the most popular annual accounting conferences that’s geared toward QuickBooks users and accounting professionals. What is QuickBooks Connect? QuickBooks Connect is an annual accounting conference held in San Jose, California. The Upcoming 2022 QuickBooks Connect.

Let's personalize your content