The 5 Most Common Small Business Accounting Mistakes

VetCPA

SEPTEMBER 8, 2022

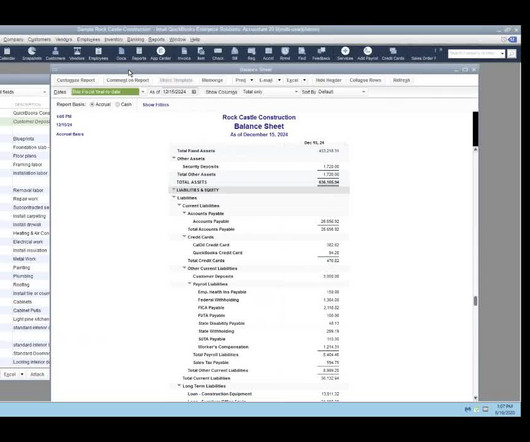

Small businesses make accounting errors and oversights regularly. Here, we cover five of the most common small business accounting mistakes. Recording everything is an excellent rule to follow for bookkeeping and accounting for a small business. You don’t take bookkeeping as seriously as you should.

Let's personalize your content