How to efficiently file a business tax return: A workflow guide for accounting firms

ThomsonReuters

DECEMBER 4, 2024

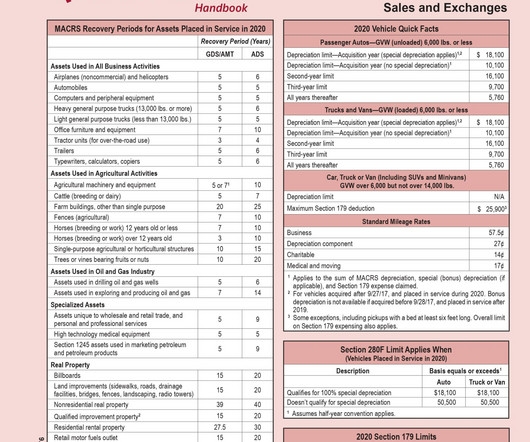

Filing business tax returns is no doubt an intricate process, but with the right workflow, accounting firms can streamline the process, reduce errors, and ensure compliance. Gather and organize client documents The first step in efficiently filing a business tax return is collecting all necessary documentation.

Let's personalize your content