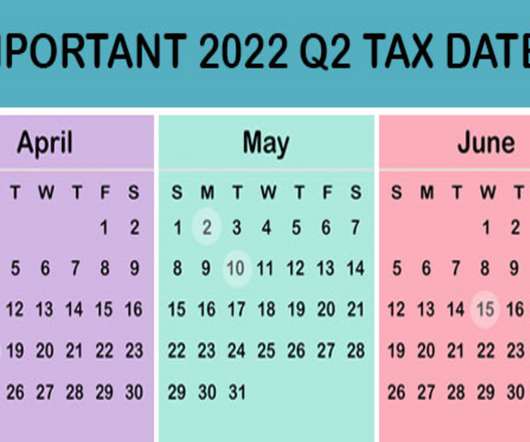

2024 Q2 Tax Calendar: Key Deadlines for Businesses and Employers

RogerRossmeisl

APRIL 17, 2024

April 15 If you’re a calendar-year corporation, file a 2023 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due. For corporations, pay the first installment of 2024 estimated income taxes. Complete and retain Form 1120-W (worksheet) for your records.

Let's personalize your content