AICPA News – May 2024

CPA Practice

MAY 10, 2024

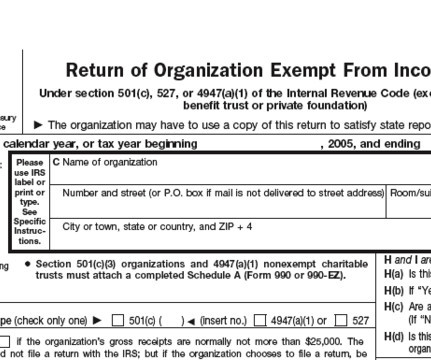

AICPA News is a recap of recent announcements from the American Institute of CPAs. ELE combines asynchronous online study with early work experience, so accounting graduates can work toward their CPA license while earning a paycheck. Yellen and take no retroactive enforcement actions for non-compliance during this time period.

Let's personalize your content