Answers to Your Tax Season Questions

RogerRossmeisl

FEBRUARY 18, 2024

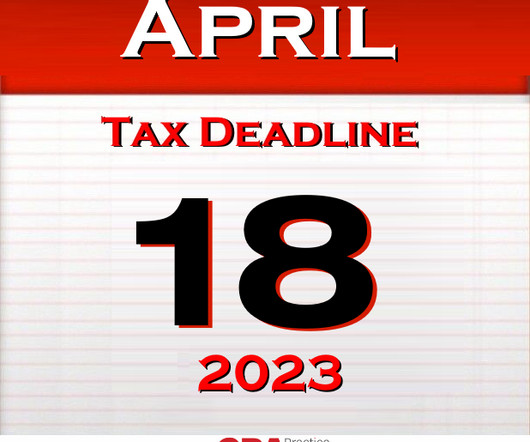

The IRS announced it opened the 2024 income tax return filing season on January 29. That’s when the tax agency began accepting and processing 2023 tax year returns. Here are answers to seven tax season questions we receive at this time of year. (1) 1) What are this year’s deadlines? Keep in mind.

Let's personalize your content