Accountants and the fight against corruption

Accounting Today

SEPTEMBER 12, 2022

BurklandAssociates

SEPTEMBER 12, 2022

Burkland’s Fintech Practice Leads Steven Lord and Smit Shukla share eight accounting gaps and issues to watch out for in the early days of scaling a startup. Startups are inherently Read More. The post Growing Pains: The Top 8 Accounting Issues We See at Startups appeared first on Burkland.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

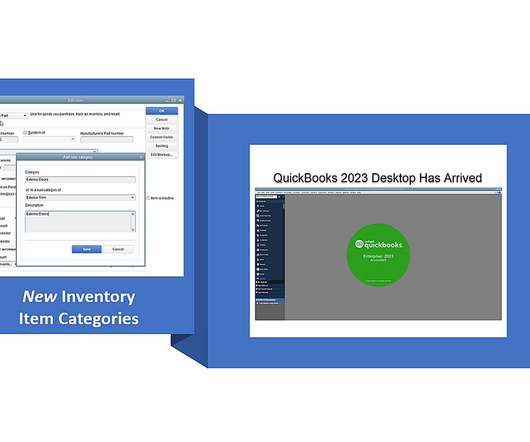

Intuitive Accountant

SEPTEMBER 12, 2022

If you are using QuickBooks Enterprise, in the US or Canada, you will have this new 'Inventory Item Category' feature to assist you in establishing a meaningful hierarchy of your inventory, but it will take some thought setting it up.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Patriot Software

SEPTEMBER 12, 2022

As a business owner, running errands is inevitable. But sometimes, you are too busy to make the run yourself. You might send an employee to pick up something or handle a task for you. If you find yourself counting on employees to use their personal cars for business, consider offering mileage reimbursement. So, what is […] READ MORE.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CTP

SEPTEMBER 12, 2022

written by Lyle Solomon. Taxes can be stressful. The last thing your clients, who probably wear multiple hats, want to do is send more of their hard-earned money to the government. Fortunately, various tax reduction techniques are available to help your clients lower their taxable liability. How to reduce your client’s children’s taxes. Consider some of the strategies listed below if your clients want to reduce their children’s taxes. 1.

Intuitive Accountant

SEPTEMBER 12, 2022

Kelly Gonsalves caught up with Diane Gilson during Scaling New Heights 2022 to discuss her business and what being Insightful Accountant's 2022 ProAdvisor of the Year means to her.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Patriot Software

SEPTEMBER 12, 2022

If you offer employer-sponsored insurance to your employees, you should be familiar with some of the health coverage terminology used in the workplace. Open enrollment is one important term related to insurance benefits. What is open enrollment? What is open enrollment? Open enrollment is an annual period where individuals can enroll in, make changes to, […] READ MORE.

Snyder

SEPTEMBER 12, 2022

I bet almost everyone has thought that it would be nice to open a cozy little store and sell their own handmade items, or perhaps stuff that they no longer use but is still in good condition. Perhaps you would even like to own a vintage store like that one on the first floor of a stunning residential complex downtown. Surely, in our vast world, there are people who will want to buy your niche products.

Patriot Software

SEPTEMBER 12, 2022

Having workers’ compensation insurance isn’t only a smart business move—in most cases, it’s a required one, too. But doling out lump sum payments for workers’ compensation premiums can take its toll on your business. Instead, opt for pay as you go workers’ comp. Workers’ compensation insurance basics What is workers’ compensation? Workers’ compensation is a […] READ MORE.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Patriot Software

SEPTEMBER 12, 2022

The tax world is overflowing with funky-sounding acronyms, and FUTA might be the strangest one out there. You may be wondering, What is FUTA tax? The Federal Unemployment Tax Act (FUTA, for short) is a federal law imposing an unemployment tax on employers. If you’re an employer, you have to know about FUTA tax—because you’ve […] READ MORE.

Intuitive Accountant

SEPTEMBER 12, 2022

Kelly Gonsalves met up with Alisha Raesz during the recent Scaling New Heights conference to discuss what being Insightful Accountant's 2022 Up-n-Comer ProAdvisor means to her and her business.

Patriot Software

SEPTEMBER 12, 2022

Meeting deadlines is stressful when you’re running a business. Many small business owners are especially stressed when it comes to meeting IRS tax filing deadlines. Don’t you just wish you had a way to extend your filing due date? Cue Form 8809. What is Form 8809? Have more questions about IRS tax forms and filing […] READ MORE.

Intuitive Accountant

SEPTEMBER 12, 2022

Kelly Gonsalves caught up with Andrew Wall recently to discuss what being an Insightful Accountant Top 100 ProAdvisor means to him and his business.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Patriot Software

SEPTEMBER 12, 2022

Hiring salaried employees can eliminate some of the guesswork out of wage calculations. Typically, an employee earning a salary receives the same amount each pay period. But, what happens when an employee takes an unpaid day of work? In these situations, you must know how to prorate salary. What is a prorated salary? You pay […] READ MORE.

Intuitive Accountant

SEPTEMBER 12, 2022

Kelly Gonsalves caught up with Liz Scott and M.B. Raimondi to discuss what it means to be an Insightful Accountant Top 100 ProAdvisor and ProAdvisor of the Year.

VJM Global

SEPTEMBER 12, 2022

GSTR-3B is a crucial document as it provides a summary of GST output and Inputs to the government. In Table-4 of GSTR-3B, bifurcation is provided of Input Tax Credit availed by the taxpayer. However, the government noted that in various cases taxpayers were making incorrect disclosures in Table 4 leading to false information to the government. Therefore, the government suggested various changes in Table-4 of GSTR-3B vide Notification No. 14/2022- Central Tax dated 5th July 2022 and clarified var

Intuitive Accountant

SEPTEMBER 12, 2022

Kelly Gonsalves caught up with Susan Pruskin during Scaling New Heights to discuss what it means to her and her business to be an IA top 100 ProAdvisor.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Withum

SEPTEMBER 12, 2022

Fair Market Value in the healthcare arena is multifaceted, touching upon a number of aspects for healthcare organizations. At its core, it exists for consumer protection and to guard against the potential for fraud and abuse. Listen in as Tom Reck of Withum and Isabelle Bibet-Kalinyak of Brach Eichler, as they discuss and illustrate FMV in the context of the most recent elements of the Stark law and the Anti-kickback statute, including penalties associated with violations of the same.

Intuitive Accountant

SEPTEMBER 12, 2022

Kelly Gonsalves recently caught up with Caleb Jenkins to disucss what being an Insightful Accountant Top 100 ProAdvisor means to him and his business.

Withum

SEPTEMBER 12, 2022

Withum is proud to announce that Crain’s New York named Sareena Sawhney on their 2022 Notable Leaders in Accounting & Consulting list. Sareena Sawhney was honored by the publication along with 63 other honorees in the industry. Sareena Sawhney , MBA, CFE, CAMS, MAFF, is a Principal in Withum’s Forensic and Valuation Services group. An expert in complex fraud investigations and forensic accounting, Sareena conducts fraud and white-collar investigations, shareholder disputes and bankruptcy fra

LSLCPAs

SEPTEMBER 12, 2022

If you were planning to buy equipment anyway, DO IT NOW to take advantage of the 100% depreciation deduction! The Tax Cuts and Jobs Act (TCJA) temporarily allowed 100% expensing for business property acquired and placed in service after September 27, 2017, and before January 1, 2023. The IRS has recently changed laws relating to deductions, depreciation, The post Temporary 100% “Bonus Depreciation” Decreases by 20% Per Year Starting in 2023 appeared first on LSL CPAs.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Withum

SEPTEMBER 12, 2022

What Exactly Is the Metaverse? No, it’s not an expansion of a superhero universe… The metaverse was created through Web3 technology, an evolutional improvement of the Web2, the technology driving the internet as we know it. Web3 tech indoctrinates blockchain tech, decentralization, and token-based economics into the foundation of the internet set by Web2.

CTP

SEPTEMBER 12, 2022

written by Lyle Solomon. Taxes can be stressful. The last thing you want to do is send more of your hard-earned money to the government. Fortunately, various tax reduction techniques are available to help families with children lower your taxable liability. Consider some of the six strategies listed below if you want to reduce your children’s taxes. 1.

Withum

SEPTEMBER 12, 2022

Since 2003, dealerships have been charged with safeguarding and protecting consumer information. Many of our clients have worked diligently to comply with the Federal Trade Commission’s requirements. Coordinators were assigned, risks were assessed, policy manuals were written, and tests were conducted. Our firm might have even assisted your dealership in completing these tasks.

Intuitive Accountant

SEPTEMBER 12, 2022

Sage's Dustin Stephens goes inside how the new Sage Field Operations Integration with Sage Intacct Construction is helping today's construction financial professionals.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content