Accounting Today news quiz: April 26

Accounting Today

APRIL 26, 2024

Test your knowledge of the biggest accounting headlines of the week. No. 2 pencil not required!

Accounting Today

APRIL 26, 2024

Test your knowledge of the biggest accounting headlines of the week. No. 2 pencil not required!

CPA Practice

APRIL 26, 2024

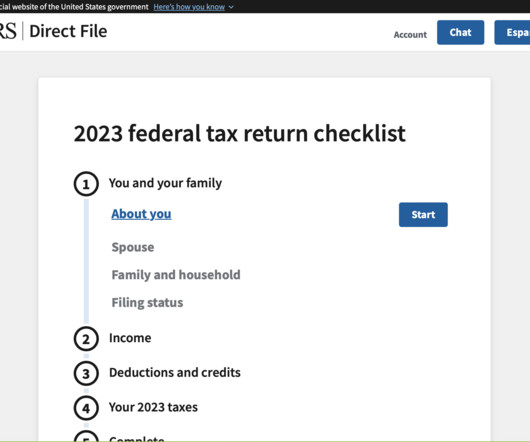

With the 2024 filing season in the rearview mirror, the IRS provided an update Friday on how well its Direct File pilot program fared this year but said little about what the future holds for its prized tax-filing service. “From the very beginning of the Direct File pilot, we wanted to test new ways to give taxpayers an easy, accurate, and free way to file their taxes online directly with the IRS,” IRS Commissioner Danny Werfel said on April 26.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Randal DeHart

APRIL 26, 2024

In the world of small businesses, positive cash flow is king. The driving force keeps your business engine running smoothly, covering all your liabilities. But what happens when outflow exceeds inflow? Cash flow problems ensue, threatening the survival and growth of your construction business. These cash flow problems can originate from various sources, including macroeconomic issues like recessions, natural disasters, wars, and microeconomic problems like business decisions and performance.

Accounting Today

APRIL 26, 2024

While the term "innovation" isn't necessarily associated with most CPA firms, this perception can easily be changed with the right strategic moves.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Ace Cloud Hosting

APRIL 26, 2024

Just like for smooth money handling, you need to create a bank account. Similarly, the right accounting platform is necessary to manage the business financial landscape. This is where QuickBooks.

SchoolofBookkeeping

APRIL 26, 2024

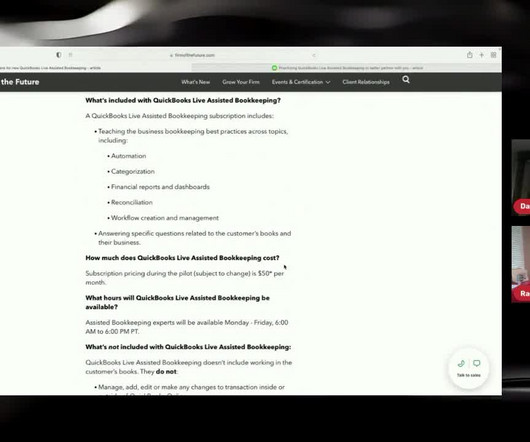

So, you're a small business owner. You've been managing your own books, stumbling through QuickBooks Online like a bull in a china shop, desperately hoping you're not accidentally committing financial seppuku. But fear not, dear entrepreneur, Intuit QuickBooks has heard your cries for help. And their solution? QuickBooks Live Assisted Bookkeeping, because apparently, managing your own finances just isn't stressful enough.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Cherry Bekaert

APRIL 26, 2024

The Financial Accounting Standards Board (FASB) issued two Accounting Standard Updates (ASUs) in the first quarter of 2024. The Government Accounting Standards Board (GASB) did not issue any new GASB Statements in the first quarter of 2024. The latest issue of the Rundown features a summary of the new standards issued in the first quarter 2024. For summaries of standards issued in previous periods, view our previous rundowns here.

Accounting Today

APRIL 26, 2024

The Internal Revenue Service's Direct File pilot program officially closed Friday, after 140,803 taxpayers used it in 12 states.

Ronika Khanna CPA,CA

APRIL 26, 2024

As business owners and employees are increasingly working remotely, often from their home offices , it helps to set up an infrastructure where business functions can be handled online. This includes tax payments, which tax agencies have tried to make as easy as possible by offering several options. The benefit of making tax payments online is that they allow businesses reduce the hassle of manually transcribing information onto forms that then have to be mailed in along with a cheque, before a c

Accounting Today

APRIL 26, 2024

The bank successfully fought off a London court claim brought by investors over tax breaks linked to financing for 'Pirates of the Caribbean 2.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Going Concern

APRIL 26, 2024

This past February, the PCAOB released KPMG’s 2022 inspection report but inexplicably redacted the firm’s deficiency rate. To say this was very strange would be minimizing the situation, something we aren’t generally known to do. VERY strange. CAPS exclamation points Confused Nick Young meme strange. This isn’t something we’d ever seen, certainly not in a Big 4 inspection.

Accounting Today

APRIL 26, 2024

Plus, the Kansas Society of CPAs gives out scholarships; the Accounting MOVE Project announces a mini summit; and more.

CPA Practice

APRIL 26, 2024

By Natallie Rocha, The San Diego Union-Tribune (TNS) Katherine Lu Acquista, 47, pleaded guilty to wire fraud in federal court Thursday, admitting to stealing more than $430,000 for her own personal expenses while she was the director of operations and accounting for the San Diego Regional Economic Development Corporation (EDC). She carried out the scheme for about five years, from 2017 to 2022, according to court records.

Accounting Today

APRIL 26, 2024

The Los Angeles-based boutique investment bank's audit by Marcum cited multiple material weaknesses in the company's reporting, and some of the previously reported data was revised.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

APRIL 26, 2024

The Private Company Council ( PCC ) met on Thursday, April 18, 2024. Below is a summary of topics discussed by PCC and FASB members at the meeting: PCC Agenda Priorities: PCC members discussed their agenda priorities and the factors that should be considered in their determination. PCC members supported conducting preliminary research on the following areas: debt modifications and extinguishments, credit losses—short-term trade accounts receivable and contract assets, lease accounting simplifica

Accounting Today

APRIL 26, 2024

Even if a program is predominantly funded with federal dollars, there may be other sources of funds from which local governments can draw.

CPA Practice

APRIL 26, 2024

PKF O’Connor Davies, one of the nation’s largest accounting, tax and advisory practices, has established the PKF O’Connor Davies University as a formalized, enhanced approach to team members’ continuing education. Designed as a key element of the organization’s recently launched career development program, Pathways to Success, PKF O’Connor Davies University provides team members with an array of industry-specific training, coaching and certification opportunities that are foundational for career

Accounting Today

APRIL 26, 2024

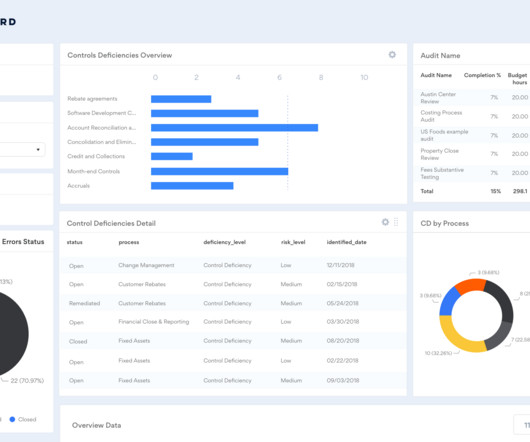

AuditBoard announces AuditBoard AI now generally available; Earmark launches web app; and other accounting technology news.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Cherry Bekaert

APRIL 26, 2024

Company Background The Company is a prominent player in commercial and residential real estate construction, operating across the southeast of the U.S. With more than five million square feet of space developed or redeveloped, the Company focuses on retail, multi-family, hospitality, office, industrial and residential properties. Its success is underpinned by conservative investments and a commitment to high-quality projects, fostering long-term relationships with major retailers and commercial

Accounting Today

APRIL 26, 2024

We're witnessing the evolution of the "new firm.

CPA Practice

APRIL 26, 2024

By Arcelia Martin, The Dallas Morning News (TNS) Within 45 minutes of the Federal Trade Commission posting its latest ruling outlawing noncompete clauses , Ryan, a Dallas-based global tax services firm, filed the first of what would soon be a slew of lawsuits against the ban. Business groups in Texas and across the country are fighting the FTC’s decision to prohibit agreements between companies and workers that typically bar employees from working for competitors in the future or starting a simi

Accounting Today

APRIL 26, 2024

The bakery chain collapsed into insolvency in 2019 after a forensic investigation revealed thousands of false entries in its accounts.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Cherry Bekaert

APRIL 26, 2024

Over the past four decades, enterprise resource planning (ERP) solutions have evolved to incorporate new technologies and have expanded their reach to support back-end business processes as well as front-office functions, driving massive efficiencies across business operations enterprise-wide. By 2025, the ERP market is expected to exceed $49.5 billion, with defense and aerospace, retail, and government utility sectors driving its growth. 1 With the rapid adoption of AI, cloud technology, and ad

Anders CPA

APRIL 26, 2024

Jeanne Dee, CPA/CGMA, audit and assurance partner at Anders, will be honored by the University of Missouri – St. Louis at the Salute to Business Achievement Awards. The award recognizes UMSL Business graduates who’ve made outstanding contributions to their community, profession and the university. Honorees are selected by leadership in the College of Business and the Alumni Association’s College of Business Alumni Chapter.

Ace Cloud Hosting

APRIL 26, 2024

Just like for smooth money handling, you need to create a bank account. Similarly, the right accounting platform is necessary to manage the business financial landscape. This is where QuickBooks.

Going Concern

APRIL 26, 2024

ICYMI: These are the most read stories on Going Concern this week Deloitte Checks in on Women at Work, the Results Aren’t Good PwC Announces It’s ‘Aligning Its Organizational Structure’ and Using Fewer BS Words in Job Titles KPMG Was Too Cheap to Pay Foreign Graduates More So They Yanked All Their Job Offers The PwC Partner Class Will Be Much Smaller This Year Accounting Firms Will Not Be Leading the AI Revolution Big 4 KPMG hires ex-prisoners as part of Gov strategy to tackle £18bn reoffending

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content