What happens if you miss a tax deadline for a client?

Accounting Today

JANUARY 11, 2023

CPA Practice

JANUARY 11, 2023

By Chris Farrell, CPA. Most practitioners pride themselves on delivering accurate, complete, and timely information to clients, and engaging with them in a friendly and focused way. This earns repeat business and referrals, because compared to a firm who does not deliver in a reliable manner and who might not be as friendly, the positive and timely firm always wins.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

JANUARY 11, 2023

Back in August when it was announced that Guidehouse would be buying Grant Thornton’s public sector advisory practice , we wondered out loud if layoffs might be expected as they so often are in situations such as these. First, let’s do a quick refresher on the acquisition as reported in August: A tipster reached out to us this morning to let us know the rumor mill is churning over Guidehouse potentially picking up GTPS.

CPA Practice

JANUARY 11, 2023

Fourth quarter 2022 estimated tax payments are due on or before January 17, 2023. Many taxpayers, especially the self-employed, are required to make quarterly estimated tax payments during the year, and others do so voluntarily to stay current on their taxes. Quarterly payments are generally due by the 15th of January, April, June and September. January 15 falls on a weekend this year, and January 16 is a holiday observing Martin Luther King, Jr.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Insightful Accountant

JANUARY 11, 2023

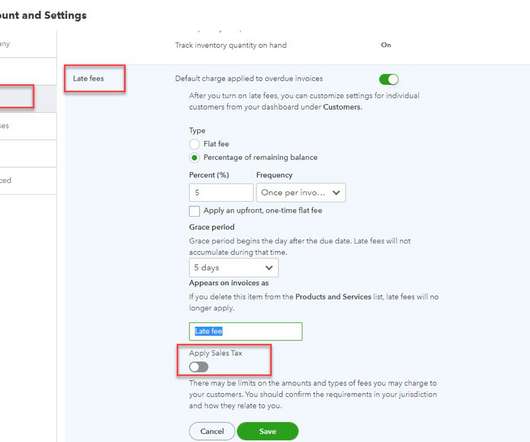

Internationally renowned ProAdvisor Esther Friedberg Karp shares some of the QBO features she wishes would have made it to the Canadian market.

Patriot Software

JANUARY 11, 2023

Software can make payroll—and your life—much easier. But it’s easy to get overwhelmed when shopping for payroll software. After all, there are a variety of tools to choose from. And as a savvy business owner, you want to find the best fit for your company. So, what is the best payroll software for small business? […] Read More.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Going Concern

JANUARY 11, 2023

Jan. 1 was a big day for 109 overachievers at RSM US as their long journeys in public accounting finally culminated in being promoted to partner or principal. The class of 2023 has the most members by far in recent years, topping the 88 new partners and principals in the class of 2022 , followed by classes of 84 , 80 , and 68. The person who will be ordering these 79 men and 30 women around said this about the class of 2023: “I am pleased to congratulate our new partners and principals on this e

AccountingDepartment

JANUARY 11, 2023

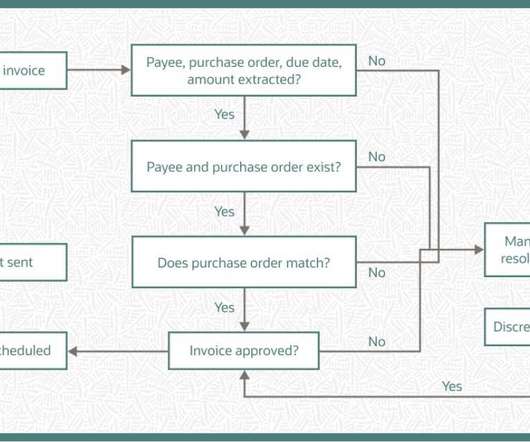

With every invoice a company receives, there is an associated cost that comes along with it. The cost of reviewing, processing, and paying the invoice. Now while this particular cost may not be all monetary, there is a cost that comes with the substantial amount of time it takes to handle such a task.

Going Concern

JANUARY 11, 2023

The following article was in a recent CPA Letter Daily sandwiched between a JofA piece on how Latino CPAs found strength in numbers (pun intended?) through the ALPFA and BPM transformation officer Lindsay Stevenson talking about remote work and change fatigue on the JofA podcast. Like many articles in this vein, this Bloomberg piece encourages employers to think beyond salary when thinking about talent.

CTP

JANUARY 11, 2023

Aside from contribution-only donations to established 501(c)(3) charities, the gift/non-gift distinction has always been rather subjective. For example, assume you give money to a children’s choir which then performs at your wedding. The financial value of that quid pro quo is subjective, at best. Crowdfunding contributions have muddied the waters even further.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

CPA Practice

JANUARY 11, 2023

Paul Munter, who has served as acting chief accountant at the Securities and Exchange Commission (SEC) since January 2021, was appointed chief accountant on Wednesday. As chief accountant, Munter will continue to lead the Office of the Chief Accountant and serve as the principal advisor to the SEC on accounting and auditing matters. He also will be responsible for assisting the SEC on matters involving both the Financial Accounting Standards Board (FASB) and the Public Company Accounting Oversig

CTP

JANUARY 11, 2023

Aside from contribution-only donations to established 501(c)(3) charities, the gift/non-gift distinction has always been rather subjective. For example, assume you give money to a children’s choir which then performs at your wedding. The financial value of that quid pro quo is subjective, at best. Crowdfunding contributions have muddied the waters even further.

CPA Practice

JANUARY 11, 2023

The Illinois CPA Society and its charitable partner, the CPA Endowment Fund of Illinois, have announced the latest group of young aspiring professionals to complete its award-winning and highly competitive Mary T. Washington Wylie Internship Preparation Program: Full Name College Hometown Brighet Akinnuwesi University of Illinois at Springfield Springfield, Ill.

Shay CPA

JANUARY 11, 2023

Digitalization makes our world smaller by the day. And that means that as you’re hiring for your startup, you don’t necessarily want — or need — to limit yourself to recruiting domestically. Historically, the problem with hiring someone in another country has largely come down to two things: getting them paid and managing the associated tax liability. .

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Summit CPA

JANUARY 11, 2023

The Virtual CPA Success Show: Episode 71. In this episode, Jamie Nau, our host and Summit CPA's Director of Virtual CFO, and Jody Grunden, Partner at Anders CPAs + Advisors, sit down with Sandy Gerber, Communication Strategist and author of Emotional Magnetism. They discuss what emotional magnetism is and how it can help develop stronger relationships in all areas of life.

Basis 365

JANUARY 11, 2023

Do you outsource or not? This is the question. Let's say you're like most managers and business owners. You may be like most business owners and managers, who often consider outsourcing some or all their accounting projects. However, they are still determining the possibility. Outsourcing requires a little faith. This is a risk worth taking, especially if a team of skilled accountants has the experience and knowledge to adapt outsourced accounting services to your company's unique numbers-relate

SkagitCountyTaxServices

JANUARY 11, 2023

How is your year starting out? We’re into week 2 of 2023 … would love to hear back from you on what are the challenges you’re facing in your Skagit County business finances right now. Relatedly, what are your customer service goals for this year? One customer relations tool that seems outdated (but is still very relevant): phone calls. Yes, we know there are chatbots and instant messages and many people opt for those avenues first.

Insightful Accountant

JANUARY 11, 2023

See what ApprovalMax Solution Engineer Alex Gusman has to say about how the all-in-one tool can better streamline your accounts payable process.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Insightful Accountant

JANUARY 11, 2023

Check out you can manage all your business payments in one place, pay bills with automated approvals and streamline the entire payment process.

Insightful Accountant

JANUARY 11, 2023

If you haven't booked your spot yet, now is the time to join Mark Wickersham presents 'The Profitable Bookkeeping Conference 2023.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

Menzies

JANUARY 11, 2023

Menzies LLP - A leading chartered accountancy firm. The Worldwide Disclosure Facility (WDF) opened in September 2016 and is an HMRC process which allows anyone who needs to disclose a UK tax liability that relates wholly or partly to an offshore issue to do so. Offshore issues include unpaid or insufficient tax paid in relation to: income arising from a source in a territory outside the UK. assets situated or held in a territory outside the UK. activities carried on wholly or mainly outside the

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Airbase

JANUARY 11, 2023

Is your finance team getting the love and attention they deserve? Typically overworked and underappreciated, finance teams are a serious flight risk. In fact, the Wall Street Journal reports that more than 300,000 accountants and auditors quit over the last two years, and the effects of those losses can be significant. Staffing problems in the finance department can impact an entire company.

Lockstep

JANUARY 11, 2023

Connected accounting pioneer provides only free online portal to help accounting teams close books even faster. Seattle, WA – (January 10, 2023) – Lockstep , the connected accounting network, today announced Lockstep Self-Service, the latest application in the Lockstep Suite. Lockstep Self-Service provides customers and vendors with immediate access to reconcile their statement, download important documents, view transaction history, and export accounting data.

Advertisement

"Offer payroll and do it yourself,” they said. “It’ll be fun!” Spoiler alert: It was not fun. Most CPA firms know that they need to offer payroll services to their clients or risk losing them to another firm that will. However, many don’t really want to. It is often time-consuming and complex due to changing tax laws and regulations, and with the growing staffing shortages, most just don’t have the resources.

Let's personalize your content