Survey: Accountants are burning out

Accounting Today

JULY 19, 2022

Canopy Accounting

JULY 27, 2022

Have you ever wondered how the rest of the world views your job? Entertainment can sometimes give us a peek through that window. Usually, when we want to plug into TV or movies, it’s to escape our daily lives. But, sometimes, it can be fun to watch shows about our lives, especially our work lives! There’s shows about doctors, lawyers, IT teams, journalists, government officials and a myriad of other professions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

RogerRossmeisl

JULY 31, 2022

Excerpt of an article posted to the Memos by Heller House website on 7/27/22 In their book The Innovator’s Solution, Clayton Christensen and Michael Raynor cite the example of IBM as a cautionary tale against outsourcing activities that “might seem to be a non-core activity today” but that “might become an absolute critical competence to have mastered in a proprietary way in the future” IBM decided to outsource the microprocessor for its PC business to Intel, and it

TaxConnex

JULY 26, 2022

Partnerships, just like your sales tax obligations, evolve over time. Sales tax is not a set it and forget it task, so if you’ve handed things off and aren’t sure how things are going, it may be time for a check-up with your provider. By examining a handful of operational indicators, you can assess whether your provider is still the right fit for your business.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Going Concern

JULY 13, 2022

On May 20 the Houston headquarters of R&D tax credit consulting firm Alliantgroup was raided by the IRS , in the weeks since we’ve had plenty of speculation about the whys and we’ve heard countless accounts from current and former Alliantgroup employees about the “evil, toxic, and emotionally damaging company” that employed them.

Xero

JULY 11, 2022

We recently held our fourth Xero Responsible Data Use Advisory Council meeting via Zoom with seven council members across four time zones to discuss the most important emerging trends around responsible data use for small businesses. How time has flown – we’ve nearly completed our first year of a council. The council includes myself, Samuel Burmeister of Tall Books (advisor), Laura Jackson of Popcorn Shed (business owner), Maribel Lopez of Lopez Research (analyst), Wyndi and Eli Tagi of WE Accou

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Intuitive Accountant

JULY 19, 2022

Utilizing the Maslach Burnout Inventory for the first time in an accounting setting, FloQast's survey reveals the alarming extent of burnout on professionals and its impact on critical accounting processes.

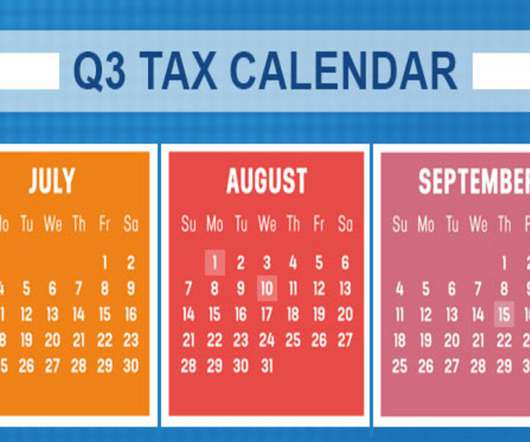

RogerRossmeisl

JULY 16, 2022

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due.

TaxConnex

JULY 19, 2022

Online retailers face a lot of challenges today. Sales tax obligations are among them. It’s been four years since these obligations began landing on businesses’ plates nationwide, and the situation isn’t getting any easier. Only now are federal lawmakers beginning to wonder if the current sales tax landscape overburdens online businesses. In the meantime, your business may have to start collecting and remitting states’ sales tax – with severe penalties if you don’t.

BurklandAssociates

JULY 26, 2022

Reduce SaaS churn by fostering a culture that listens to customers and puts their needs at the center. Here are some specific tips to help. The post Reduce SaaS Churn – Strategic Tips for Startups appeared first on Burkland.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

VetCPA

JULY 19, 2022

Comparing a business’s key financial ratios with industry standards and with its own past results can highlight trends and identify strengths and weaknesses in the business. Financial statement information is most useful if owners and managers can use it to improve their company’s profitability, cash flow, and value. Getting the most mileage from financial statement data requires some analysis.

MyIRSRelief

JULY 1, 2022

Are you in need of a tax preparation expert in Santa Fe Springs? More than enabling your problem to grow and acquire more fees, penalties and fines, we can help you with your business bookkeeping and tax preparation needs. We are a firm with experts in auditing and resolving IRS issues, we can help you find solutions to your tax problems. You need an expert in tax preparation services in Santa Fe Springs in California to enable your business to find the appropriate tax resolution and get help.

RogerRossmeisl

JULY 17, 2022

Fraud risk assessments have been shown to prevent occupational fraud and limit losses for victimized organizations. These tools have become more prevalent in recent years, according to “Occupational Fraud 2022: A Report to the Nations” published by the Association of Certified Fraud Examiners (ACFE). But although almost 50% of businesses perform fraud assessments, many owners and managers may be unaware of the value of these procedures and how the assessment process works.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

TaxConnex

JULY 5, 2022

Can U.S. companies sell profitably to the north? Sure, if statistics are any indication Canada is the 10th-largest eCommerce market in the world estimated at 35 billion USD last year. Sounds enticing. What about the sales tax obligations? Our neighbors to the north share several similarities with the United States when it comes to sales tax – but there are key differences.

BurklandAssociates

JULY 18, 2022

More than ever, startup founders and investors recognize the importance of cultivating an engaged, high-performing team and the work that goes into building and maintaining a strong company culture. In Read More. The post 3 Ways People Operations Impacts Fundraising Success appeared first on Burkland.

Intuitive Accountant

JULY 28, 2022

In today's changing workplace, many organizations are looking to complement their full-time staff with independent contractors to grow their business. WorkMarket's Bridget Quinn Kirchner explains how it works.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Going Concern

JULY 13, 2022

We all have that one friend whose door is always open to us. This person has been with you through all the ups and downs, and uneventful middle parts between. You trust this person because they’ve never let you down, their advice is always solid. What if clients thought of you as that friend? What if when something happens with your client’s business you are the first one they think of to call?

RogerRossmeisl

JULY 16, 2022

Employee stock ownership plans (ESOPs) provide tax-saving opportunities for business owners who want to cash out and transfer ownership to employees without immediately giving up control of the business. However, valuing stock held by an ESOP is an ongoing challenge for the fiduciaries who administer them, especially when the sponsoring company is privately held.

TaxConnex

JULY 21, 2022

Understanding economic and physical nexus and the taxability of your products and services goes a long way to ensuring your sales tax compliance. But nothing’s that simple with sales tax. Here’s a look at a few other things you should keep in mind – including how to avoid hefty penalties. Off to marketplace. Economic?nexus requires remote sellers to collect sales tax because they hit certain thresholds of revenue or sales in states.

BurklandAssociates

JULY 12, 2022

A few years ago, I met a pre-seed founder, Angie, with an excellent MVP, a handful of customers, and the infectious passion and drive that excites me. Angie had domain Read More. The post Identifying the Ideal Investor for Your Startup appeared first on Burkland.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Withum

JULY 20, 2022

As far as the IRS is concerned, not all tax scams should be treated equally. Last month the Service announced which scams made the list comprising the IRS’s “Dirty Dozen” for tax season 2022, meriting extra scrutiny. Included on the list is a wide range of tax evasion tactics. This article highlights four of them, namely syndicated conservation easements, micro-captives, return nonfiling, and secreting assets. .

Going Concern

JULY 31, 2022

Sarbanes-Oxley was signed into law by President George W. Bush on July 30, 2002. The post Happy 20th Birthday, Sarbanes-Oxley! appeared first on Going Concern.

RogerRossmeisl

JULY 17, 2022

It’s not just businesses that can deduct vehicle-related expenses on their tax returns. Individuals also can deduct them in certain circumstances. Unfortunately, under current law, you may not be able to deduct as much as you could years ago. For years prior to 2018, miles driven for business, moving, medical and charitable purposes were potentially deductible.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

TaxConnex

JULY 12, 2022

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent changes and updates. Colorado will begin imposing a 27-cent fee on every retail delivery made by motor vehicle to a destination in the state, beginning July 1. The fee will apply when at least one item is subject to sales or use tax and the delivery is mailed, shipped or delivered by motor vehicle.

BurklandAssociates

JULY 5, 2022

Not too long ago, companies in deep tech and healthcare were often overlooked for funding in favor of companies focused on consumer products and business innovation. Lu Zhang, Founder & Read More. The post A Deep Tech VC on Market Timing, Female Leadership & Diversity appeared first on Burkland.

Xero

JULY 26, 2022

Xerocon London 2022 boasted everything from inspirational keynotes, to major product announcements , and fantastic guest speakers. But, most importantly, it offered us an opportunity to come together and reconnect with our amazing community. It’s time to take a breath and reflect on an awesome event. . With this in mind, we’ll take a look back and share some of our key learnings from the Xerocon London breakout sessions. .

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content