Abolish Income Taxes? Idea Gains Some Traction in Congress

CPA Practice

JANUARY 23, 2023

By Mark Ballard, The Advocate, Baton Rouge, La. (TNS) Seeming to come out of left field, President Joe Biden last week blasted Republicans for pushing legislation that would abolish federal income taxes and the IRS then replace those revenues with a 30% or so national sales tax. “It would raise taxes on the middle class by taxing thousands of everyday items, from groceries to gas, while cutting taxes for the wealthiest Americans,” Biden said during a speech at the National Action Network’s Marti

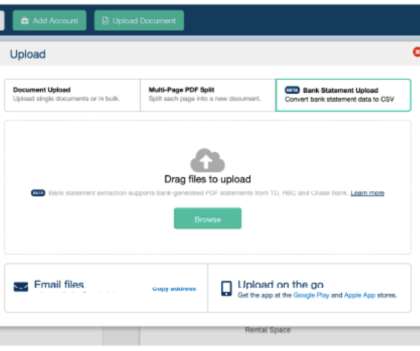

Let's personalize your content