The influence of AI-driven automation on accounting

Accounting Today

MARCH 14, 2025

The accounting profession, long regarded as a meticulous and data-driven field, is undergoing a significant transformation.

Accounting Today

MARCH 14, 2025

The accounting profession, long regarded as a meticulous and data-driven field, is undergoing a significant transformation.

Summit CPA

MARCH 13, 2025

When is the best time to fix the leak in your roof? Before the storm shows up, right? The same is true of your business. Your business needs a Chief Financial Officer before the figurative storm. And to check for that incoming bad weather, you need an accurate forecast. This is exactly what an outsourced CFO service (or a virtual CFO ) provides for your business.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mark Lee

MARCH 11, 2025

Before I share my list of seven beliefs, let me explain what led me to this position. Most accountants who contact me are struggling in some way – even those who have achieved a degree of success. Their challenges vary, but I often find myself congratulating them for taking the first step towards change. I wish it wasn’t the case, but I know that for some, booking a call with me takes a degree of confidence and courage.

Accounting Today

MARCH 12, 2025

The Securities and Exchange Commission dramatically pulled back on accounting and auditing enforcement last year after two years in a row of increases.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

MARCH 12, 2025

Bloomberg Tax & Accounting announced March 10 the launch of two new generative AI-powered features that simplify tax researchBloomberg Tax Answers and AI Assistantnow available within the Bloomberg Tax platform at no additional charge.

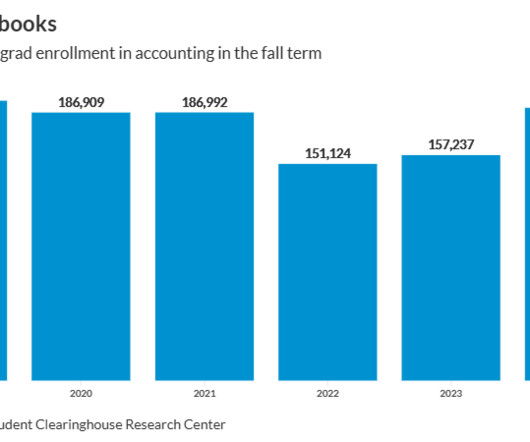

Accounting Today

MARCH 13, 2025

The latest data on the number of students studying accounting, new state tax rates for 2025 and other major metrics.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

LSLCPAs

MARCH 13, 2025

Its that time of year when we remind you to make any final contributions to your prior year IRA, Roth, or HSA accounts. These contributions are due by April 15, 2025, the first due date of personal tax returns. Due to fire disaster relief for Los Angeles, if you are a resident of LA County. The post IRA & HSA Contribution Deadlines: Dont Miss These Time-Sensitive Opportunities appeared first on LSL CPAs.

Anders CPA

MARCH 12, 2025

The landscape for digital agencies has shifted. Over the last twenty years, theres been a downward pressure on profit margins. People want to get paid more, clients want to pay less, and (thank goodness) the 80-hour work week is a thing of the past. To protect margins, marketing agencies develop complex billing and staffing models: full-time employees and freelancers working together on the same projects.

Accounting Today

MARCH 13, 2025

Accounting jobs that allow employees to work remotely may be disappearing as more employers demand people return to the office.

TaxConnex

MARCH 13, 2025

The sales tax landscape is constantly evolving, and businesses must adapt to keep pace. But tax laws aren't the only things changingbusinesses themselves are growing, diversifying, and seeking new ways to streamline their operations. According to our latest survey of over 100 finance professionals, 85% of businesses are at least somewhat likely to adjust how they manage sales tax in 2025, with 47% being very likely to make changes.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Going Concern

MARCH 10, 2025

KPMG thinks it’ll save money, open up new opportunities, and be better equipped to make widespread technology investments by consolidating local firms in its international network. In May of 2024, KPMG announced that KPMGs UK and Switzerland would merge to form a $4.4 billion MechaKPMG. Said KPMG UK chief executive Jon Holt at the time, “This marks a historic moment for both firms.

Xero

MARCH 10, 2025

Its been a massive start to 2025! In February , we shared enhancements weve made to invoicing. We also heard your feedback, and so now you can automatically prepare partnership annual accounts and tax returns using Xero data and seamlessly file them with HMRC (read more in the previous edition of Whats New). Check out more in our quarterly wrap video below.

BurklandAssociates

MARCH 11, 2025

Q2 tax deadlines are coming fast. Stay ahead of key filings, avoid penalties, and keep your startup on track with this essential guide. The post Key Q2 2025 Tax Deadlines for Startups appeared first on Burkland.

VJM Global

MARCH 10, 2025

Held by Honble High Court of Kerala In the matter of Joint Commissioner (Intelligence and Enforcement) vs. M/s Lakshmi Mobile Accessories (W.A.NO.258 OF 2025) The Assessee received consolidated Show Cause Notice under Section 74 of CGST Act for FY 2017-18 to 2023-24. The Assessee challenged such SCN in the writ petitioner wherein it was held that the department is required to issue separate SCN for every assessment year.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Withum

MARCH 13, 2025

In part one of our Unlocking Value in M&A series, we discussed how achieving synergies begins with identifying and classifying synergies, whether they manifest as cost savings through operational efficiencies or revenue growth from market expansion and cross-selling opportunities. A clear understanding of these synergies allows organizations to set realistic goals, prioritize initiatives, and align resources to focus on high-impact opportunities.

ThomsonReuters

MARCH 10, 2025

Blog home Ronan Le Gall , along with his colleagues Tim Carpenter , partner and principal at EY who leads the indirect tax technology practice for the Americas , and Vanessa Grazziotin Dexheimer , Senior Manager at EY in indirect tax and global VAT were discussing the power of clean data as an end-to-end solution for indirect direct tax processes at the Thomson Reuters Synergy Conference.

CPA Practice

MARCH 10, 2025

WalletHub released a new study examining which states had the highest and lowest state and local tax rates to determine where residents are giving the most and least money back to their respective governments.

Going Concern

MARCH 13, 2025

Cornerstone Research has put out their SEC Accounting and Auditing Enforcement ActivityYear in Review: FY 2024 report [ PDF ] and then they put out a press release highlighting the important parts so we don’t have to spend all day reading it. Cheers. The U.S. Securities and Exchange Commission (SEC) drastically reduced its accounting and auditing enforcement activity in fiscal year 2024, the final year of Gary Gensler’s administration, ending two consecutive years of annual increases

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Today

MARCH 11, 2025

The total lifetime tax amount in the highest-paying state is $755,493.

Basis 365

MARCH 9, 2025

As your business grows, so does the complexity of your financial operations, making it essential to have a skilled controller overseeing your financial reporting, cash flow, and internal controls. But is it better to create a position in-house or hire fractional controller services ? Each option has distinct benefits and drawbacks, depending on your companys size, budget, and financial needs.

Xero

MARCH 10, 2025

A year ago, we shared our vision to reimagine accounting using AI and mobile , recognizing the transformative potential for small businesses and the industry. As part of delivering on that vision, we launched Just Ask Xero (JAX), our smart and reliable generative-AI business companion, to make accounting tasks easier and save you time through simple conversation within everyday apps.

Withum

MARCH 13, 2025

How a Not-for-Profit Organization Aligned Risk Strategy with its Mission for Greater Impact. Executive Summary A global not-for-profit organization dedicated to advancing philanthropy and social impact recognized the need to enhance its Enterprise Risk Management (ERM) framework to support its global expansion and long-term sustainability. The organization aimed to strengthen risk oversight, improve governance and reinforce stakeholder confidence to meet growing donor expectations and regulatory

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Today

MARCH 11, 2025

Rep. Steve Cohen has re-introduced a bill that would give the IRS the authority to set and enforce standards for tax pros.

CPA Practice

MARCH 13, 2025

Theres no better feeling than getting paid quickly and seeing the money in a snap. Intuit introduces Tap to Pay and Recurring Payments features for iPhone users.

ThomsonReuters

MARCH 10, 2025

Blog home For large companies operating in a digitalized global economy, indirect tax compliance has evolved from an arduous manual task to a largely hands-off process performed by sophisticated tax technologies that execute most tax functionsdata gathering, computation, reconciliation, invoicing, reporting, filing, etc.automatically and in close to real time.

Accounting Insight

MARCH 13, 2025

CAS 360 is a comprehensive company secretarial and AML management software that allows clients to electronically prepare and file company registration forms with Companies House while generating supporting documents to meet legislative requirements. The software streamlines compliance by automating the preparation of forms, minutes, resolutions, registers, and documents required for the Annual Confirmation Statement and common company changes.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Today

MARCH 14, 2025

The median unclaimed tax refund from 2021 is $781, but it has to be claimed by April 15.

CPA Practice

MARCH 12, 2025

Going without income as a result of unemployment creates financial stress, but there are ways to make it a little bit easier.

Going Concern

MARCH 13, 2025

Are you having trouble finding remote accountants, CAS experts, auditors, or tax professionals for your firm or internal team? Accountingfly can assist you! With our Always-On Recruiting service, you can access a pool of top remote accounting candidates without any upfront costs. Sign up now to view the complete candidate list and connect with potential hires.

AccountingDepartment

MARCH 13, 2025

In the constantly changing world of business, a single approach seldom suits everyone. This is especially applicable to financial management. Whether you're an emerging startup or a well-established company, maintaining a strong understanding of your finances is essential.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content