What information is provided in Chipotle’s basic 2021 financial statements?

Wendy Tietz

AUGUST 1, 2022

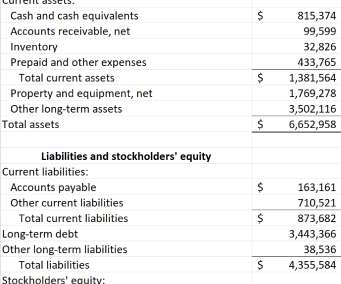

To follow are Chipotle’s four basic financial statements for its most recent year, the year ending December 31, 2021. Please note that all statements have been adapted and condensed for educational use and should not be used […]. (NYSE: CGM) is a publicly held corporation with more than $6 billion in assets.

Let's personalize your content