Missouri Enacts Economic Nexus

TaxConnex

JULY 6, 2021

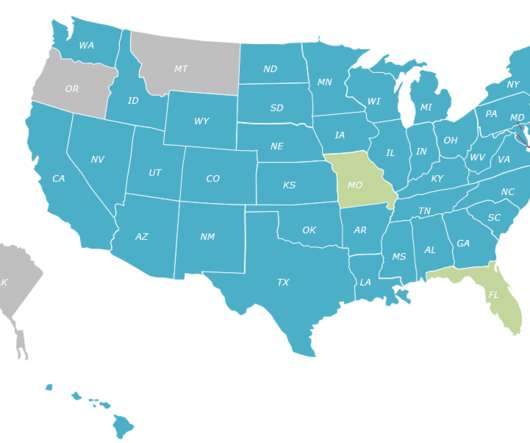

Missouri has officially become the last state with a state-wide sales tax to enact economic nexus. T he Show Me State follows on the heels of Florida , where economic nexus kicked in as of July 1 for remote sellers and marketplace facilitators. Missouri Gov. 44 other states and Washington D.C.,

Let's personalize your content